Sample nm quitclaim deed fill out & sign online dochub personal representative deed template example – Have you ever ended up gazing in confusion at an official form, feeling completely overwhelmed within a flood of technical terms? Property records, these critical legal files that transfer ownership over land and estates, may appear daunting. Don’t panic, you don’t have to be an attorney to grasp the fundamentals and draft a simple one yourself. A structured property form serves as a valuable asset, a ready-made legal structure set up to assist through the essential elements. Think of it as a guided legal framework for official records, helping make the steps easier to follow and less daunting. We’re going to break down the importance of property records, why they are necessary, and methods a predefined form can improve the efficiency of transactions.

Consider a structured document as a reliable tool in the intricate landscape of real estate contracts. Instead of staring at an empty form, overwhelmed, you have a pre-structured document, available for modifications with the specifics of your situation. Consider it a layout for your formal document, ensuring you include all key aspects without facing complications in the future.

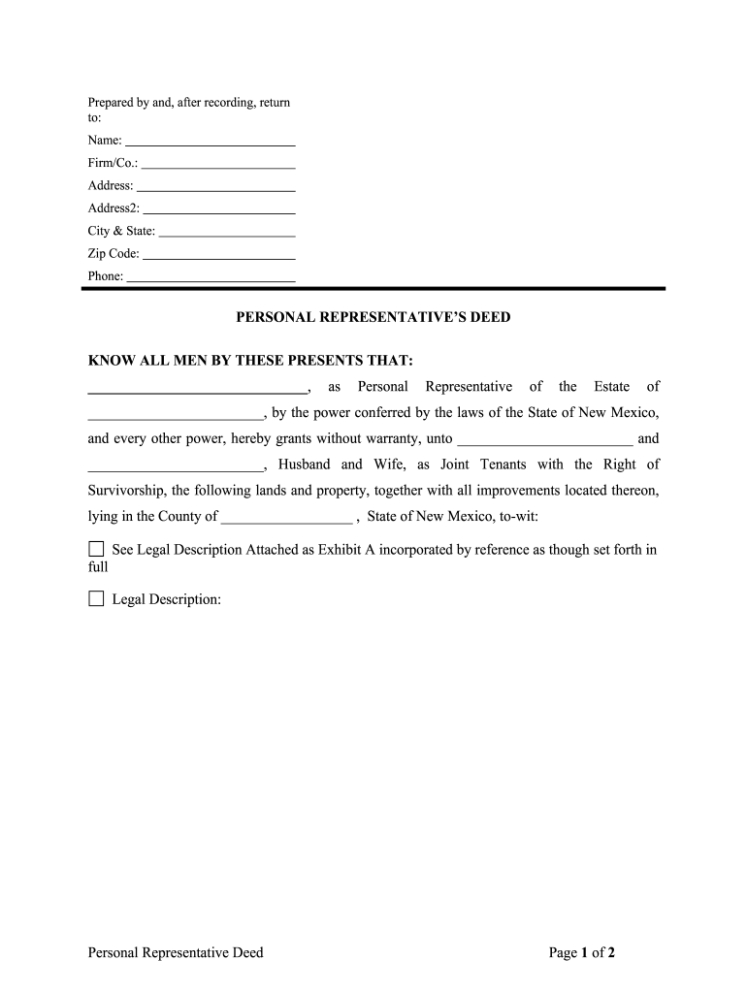

A structured ownership form is basically a legally structured record that provides a standardized format for drafting an official ownership transfer. It serves as a framework, helping you through the essential elements that must be included to ensure the document is legally compliant and enforceable. The benefit of applying a structured form lies in its ability to streamline the completion, clarifying complex legal requirements into easy-to-follow phases. It helps to avoid oversight that may compromise the title transfer, saving both time and unnecessary expenses later. It cannot replace for specialized counsel, yet it remains a practical first step.

Preformatted property documents exist for diverse uses, from transferring property ownership such as secured title agreements and informal claims to establishing easements or setting up estate plans. This variety is essential as the specific requirements for varying property documents can require unique details. For example, a secured title agreement provides the recipient maximum security, ensuring undisputed possession and securing against historical ownership issues. In contrast, a quitclaim deed simply transfers whatever interest the current titleholder possesses in the land, without any guarantees. Picking the correct legal format is crucial.

Various deed categories are recognized, each offering distinct legal safeguards to the new owner. Take a warranty deed as an illustration, offers the highest level of security, certifying that the grantor possesses valid claim to the property and can defend against disputes. Conversely, a quitclaim deed grants the lowest level of assurance, simply transferring any legal claim the seller holds in the land, without formal assurances. Picking the correct legal form is fundamental for a valid and enforceable ownership exchange.

The specific type of deed used depends on the specifics of the transaction and the level of protection provided to the recipient. Several typical variations are full-protection ownership records, basic transfer forms, and grant deeds. A fully guaranteed title contract provides the most protection, certifying that the original titleholder possesses legal ownership and the right to transfer the property. Unlike warranty documents, quitclaim records simply transfers any legal stake held by the seller, without formal protections. This document is commonly selected for estate reassignment within personal relationships or in financial agreements. Understanding the differences within these legal agreements is crucial to ensuring you’re using the right document for your unique circumstances. Make sure that you ask for help, or find help for your specific situation.

Before using a no-cost property form, do your research. Make sure it’s from a reputable source and that it includes every essential detail for your situation. Don’t forget that state laws vary significantly regarding deed requirements. What’s valid in one jurisdiction may be unenforceable in another. Seeking expert legal advice or reviewing detailed statutes into your local laws is essential to prevent ownership disputes over time. A minor expenditure for professional counsel early may spare you significant headaches later.

In the end, a no-cost property form can function as a valuable resource for recognizing the elements of a property transfer record and getting a general sense of how the transaction works. But it shouldn’t be considered a substitute for professional legal guidance, or region-based property documents. Think of it as a foundational reference for your research, and always prioritize exactness and alignment with all relevant regulations. Using a template without fully understanding its implications may result in mistakes, transaction hold-ups, or even legal challenges.

The internet is flooded with promotions for a no-cost property record, but proceeding with caution is fundamental. Not every document are of the same quality. Certain ones could be obsolete, lacking essential details, or not compliant with the regulations of your jurisdiction. As a result, locating a trustworthy provider for your property form is essential. Prioritize formats from recognized law portals, government agencies, or licensed attorney organizations. These sources are more likely to deliver correct and current property records that conform to ownership regulations.

While selecting an ownership form, it’s important to opt for a template that suits for your transaction and adheres to the regulations governing your property. Several digital sources provide property agreements, but they are not all are sufficiently comprehensive. Look for templates from verified legal entities, like official contract repositories or official regulatory offices. Be sure to carefully review the format prior to applying it, and verify it includes all fundamental aspects, such as the identities of the seller and buyer, land specification, financial terms, and authentication criteria. You can ask your lawyer for a verified deed template.

Mistakes in deeds can have serious consequences, potentially jeopardizing the transfer or causing contractual disagreements. Common errors include inaccurate estate classifications, misspelled names, and absent endorsements. To reduce the risk of complications, carefully review the property agreement before approving it and ensure that each recorded item is correct and fully documented. Reviewing the legal description is highly necessary, as even a small error could render the agreement void. Should uncertainty arise in relation to any aspect, consult an expert.

Finally, despite selecting a well-structured and customized free deed template, it remains highly advisable to consult with a real estate attorney, in cases where the transfer is complex or includes high-cost assets. An attorney can assess your drafted property document, validate its compliance with all legal requirements, and advise you on possible complications or liabilities. While a free deed template can save you money upfront, professional counsel can help avoid expensive errors in the long term.

Ultimately, a thoughtfully completed deed, whether created from scratch or adapted from a template, holds immense value. It provides clarity, safeguarding, and assurance, ensuring that your property rights are safeguarded and your specified directives are formally recorded. The impact of a well-executed deed reaches beyond the current transfer, creating a lasting record of ownership that will benefit future generations. It’s a testament of the necessity of verified paperwork and the importance of protecting your estate entitlements.