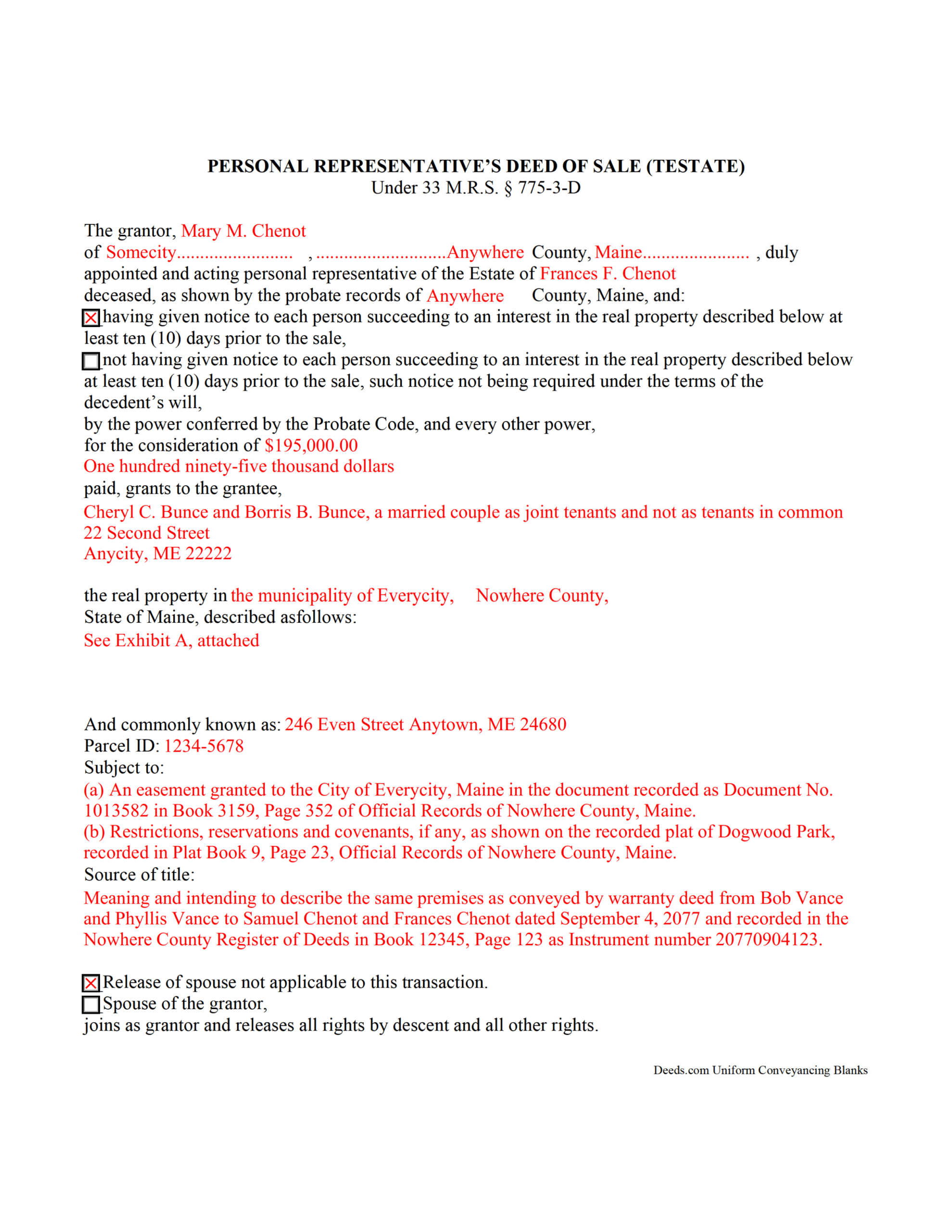

Printable lincoln county personal representative deed of sale testate form maine deeds personal representative deed template word – Do you sometimes find yourself needing a legally binding document but feeling overwhelmed by the sheer complexity of legal jargon? Many people face the same issue. Legal instruments, those time-honored documents of real estate title transfers and contractual statements, are critical for all sorts of transactions. Don’t be intimidated! You don’t have to be an attorney to create one. Here’s why a structured property form proves useful, a reliable starting point to help guarantee you handle the transaction properly.

A real estate contract, in its essence, is a formal agreement that legally passes possession of real property from the original holder to the transferor to another or rightful claimant. Think of it as the legal passing of ownership, legally speaking. Whether you are giving land to a family member, exchanging ownership of property, or adding someone in ownership records, a property deed is the key document in establishing lawful possession. Although consulting a legal professional is a recommended step, being informed on regulations and considering using a no-cost property form can save you time and money, in less complicated ownership changes.

A structured ownership form serves as a pre-designed document that ensures a consistent layout for drafting a legally binding deed. It serves as a framework, guiding you through the essential elements that must be included to ensure the document is legally compliant and recognized by law. The beauty of using a template is seen in how it to streamline the completion, breaking down intricate ownership laws into easy-to-follow phases. It prevents mistakes that could invalidate the deed, minimizing both stress and unnecessary expenses later. It isn’t a substitute for expert consultation, however, it can be an excellent foundation.

Legal instruments are the cornerstone of real estate transactions. They’re more than just pieces of paper; they function as contractual records that define and move ownership entitlements. To comprehend the importance why structured property documents are beneficial, it’s important to know what details are required in a deed. At its core, a legally recognized ownership record needs the names of the grantor (seller) and the recipient (buyer), a clear and accurate legal description of the asset, a formal declaration of title transfer, including the formal signing by the property holder, typically verified through certification. Additionally, the document must to adhere to jurisdictional regulations regarding formatting and required clauses.

There are several types of deeds, each providing different levels of protection and assurances. The widely used ones include comprehensive security documents, which offer the most comprehensive guarantee for the recipient, securing their legal rights against any title defects that may have existed even before the seller owned the property. Partial security title transfers provide moderate assurance, ensuring security solely from legal issues that developed throughout the transferor’s tenure. Conversely, quitclaim transfers provide zero assurance and merely convey any stake the grantor possesses in the property. Choosing the proper ownership document depends on the details of the title transfer and the level of risk the buyer is willing to assume.

The nature of the property agreement selected is determined by the nature of the transfer and the degree of security granted to the new owner. Some common types are warranty deeds, limited-security estate files, and asset reassignment papers. A warranty deed provides the most protection, certifying that the grantor possesses legal ownership and the authority to reassign estate rights. Conversely, a simple transfer form simply transfers any legal stake held by the seller, without any guarantees. This format is typically applied during title exchange among relatives or in financial agreements. Understanding the differences within these legal agreements is essential for confirming the appropriate contract is selected for your unique circumstances. Do not forget to get proper guidance, or find help for your specific situation.

Where can you access a property document? It is important to choose a legally recognized issuer of deed templates. Many legal websites and digital tools grant access to a collection of predefined forms for various purposes. Always verify the provider and choose a template from a legally compliant issuer who regularly updates their forms to comply with modern regulations. Prioritize forms that include clear instructions and descriptions of all aspects, as this will make the transaction far smoother. No-cost alternatives are obtainable via web platforms, however, always confirm their validity. Avoid using unverified property records. Be diligent in verifying legal details!

Ultimately, a complimentary ownership document can function as a valuable resource for identifying the key details of a property transfer record and getting a general sense of what’s involved in the process. But it shouldn’t be considered a substitute for expert attorney consultation, or state-specific deed forms. Use it as a starting point for your evaluation, and consistently focus on accuracy and alignment with every governing statute. Applying a structured form without fully understanding its implications might cause inaccuracies, transaction hold-ups, or potential disputes.

Digital resources is awash with advertisements of a no-cost property record, but taking a careful approach is fundamental. Not all templates are legally sound. Certain ones could be obsolete, missing necessary provisions, or failing to align with the laws of your specific state. Thus, finding a reputable source for your property form is highly important. Prioritize formats from established legal websites, official property archives, or bar associations. These sources are highly inclined to deliver correct and legally compliant formats that satisfy statutory obligations.

Upon drafting the ownership document, it remains crucial to obtain a legal assessment by a legal professional. A certified expert can examine the title agreement for correctness, completeness, and adherence with statutory requirements. They can also provide guidance regarding any foreseeable complications or concerns and confirm that the ownership agreement properly represents your desires. This legal analysis can provide peace of mind and reduce financial risks.

Be aware that a complimentary ownership document serves as a basic foundation. It must be tailored to match your unique case. Enter all required details correctly and comprehensively. Verify the land’s registered specifications against existing records. Ensure that both the grantor and grantee’s names are written without errors. Whenever there is doubt in relation to any aspect of the form, consult to an ownership expert or legal advisor.

In conclusion, even with a carefully chosen and personalized no-cost ownership document, it remains highly advisable to consult with a real estate attorney, particularly when the deal involves intricate details or pertains to substantial financial value. An attorney can assess your completed deed, validate its compliance with all legal requirements, and provide insights on any potential risks or liabilities. Although a complimentary ownership document may reduce initial expenses, an attorney’s guidance may mitigate financial risks over time.

Reallocating ownership should not feel intimidating. Equipped with proper details and tools, it becomes possible to oversee the process and ensure a hassle-free and compliant with the law transfer. Taking the time to understand the intricacies of deeds and exercising due diligence through evaluating and applying a no-cost property document will pay off in the long run, preserving your rights and avoiding ownership disputes.