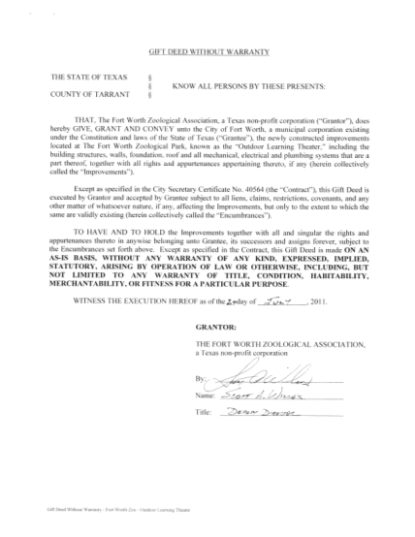

Free 21 gift deed document page 2 free to edit download & print cocodoc texas deed without warranty template excel – Do you sometimes find yourself overwhelmed in the complexity of technical legal terms when trying to transfer property? Deeds, those crucial documents that establish property rights, may appear overwhelming. But fear not! Understanding deeds doesn’t require expert certification. Within this resource, we will dive into the world of deeds, and how you can potentially get started using a complimentary property document to streamline the process. Our focus will be on ensuring ownership changes far more approachable and a little more accessible.

The advantage of a deed template is found in its layout. It serves as a blueprint, guaranteeing you cover essential details, starting with the original owner who passes title rights and the grantee who acquires possession to a clear and accurate property description. It reduces the likelihood of typical mistakes and verifies your paperwork is compliant. These templates are structured to meet statutory conditions, which lowers the risk of future disputes or challenges. You still need to be diligent as you input the necessary data, however, as incorrect or missing information could make the deed invalid.

Whether you’re transferring an estate, an automobile, or ownership rights, a deed is a crucial document. It functions as legal proof of possession transition and legally establishes the legal entitlements of both the transferor and the grantee. Even though complicated cases may demand the expertise of a legal professional, numerous simple ownership exchanges can be managed successfully with a carefully picked and correctly finalized document. Let’s discuss how these templates can empower you in managing property agreements with greater clarity and understanding.

A deed is a legal document that conveys possession of an estate from the original owner (the grantor) to the new owner (the buyer). Imagine it as an official confirmation, except for real estate. It contains essential details like the identities of both parties, a formal specification of the land, along with the transferor’s signature. Without a properly executed deed, a legal transition cannot occur. It’s the foundation of all land transfers.

There are several types of deeds, each ensuring varying degrees of security and safeguards. The frequently selected are general warranty deeds, which offer the highest level of security for the new owner, securing their legal rights against any title defects that may have existed before the grantor had legal possession. Partial security title transfers grant partial legal protection, ensuring security solely from legal issues that developed while the grantor possessed the property. Conversely, quitclaim transfers lack formal protections and simply transfer any stake the grantor possesses to the real estate asset. Opting for the best legal agreement is influenced by the specific circumstances of the transaction and the degree of liability the buyer is willing to assume.

The nature of the property agreement selected depends on the nature of the transfer and the degree of security granted to the new owner. Some common types are warranty deeds, quitclaim deeds, and grant deeds. A warranty deed offers the highest level of coverage, assuring that the grantor has clear title and the authority to pass on the ownership. A quitclaim deed, on the other hand, simply transfers any legal stake held by the seller, without assurances. This format is typically applied for estate reassignment within personal relationships or in divorce settlements. Recognizing the distinctions among these ownership formats is fundamental for confirming you’re using the right document for your specific situation. Do not forget to get proper guidance, or find help for your specific situation.

Property transfer agreements typically list key details. The necessary components consist of the full identities of the seller and buyer, an unmistakable and legally valid outline of the property being transferred, a contractual acknowledgment (detailing the agreed compensation, even if symbolic), and the grantor’s signature. The deed must also be properly notarized and recorded in the county records office to establish transparent documentation of the ownership exchange. Neglecting to follow with these regulations might make the estate record unenforceable, leading to legal challenges in the future.

Applying a structured form makes the transaction easier by offering a predefined format that directs you to fill in each essential component. This lowers the likelihood of inaccuracies and ensures that your ownership agreement complies with legal requirements. Nonetheless, it remains fundamental to keep in mind that a deed template acts solely as a reference guide. It’s necessary to be fully aware of the formal stipulations of your governing body and to obtain expert counsel should uncertainty arise or intricate situations.

Passing ownership may appear straightforward at first glance, though it tends to be a complicated procedure that requires multiple legal factors. Besides choosing the suitable ownership agreement, you are required to confirm that the property transfer is correctly finalized and legally filed. Execution involves signing the deed under the supervision of a notary public, who authenticates the legal status of all participants. Submitting the title agreement at the land registry is crucial for ensuring official documentation of the title reassignment and protecting the recipient’s estate claim. This step validates the transaction legally and accessible to the public.

An essential consideration to consider is property title protection. Legal title protection safeguards the recipient from any claims concerning ownership that could surface resulting from earlier concerns, such as unpaid liens, ownership disagreements, or deceptive estate reassignments. Although a secured property agreement offers some protection, title insurance strengthens risk mitigation, ensuring that your investment is protected. It requires a single fee that guarantees long-term security while preserving your title claim for an extended period.

Remember that a free deed template is just a starting point. You are required to adapt it to fit your specific situation. Ensure all sections are completed accurately and completely. Double-check the estate’s official details through historical archives. Ensure that the seller and buyer’s identities are written without errors. Whenever there is doubt about any part of the template, seek advice to a property specialist or certified lawyer.

At last, once the property document is authenticated and validated, it requires legal registration in the county land records office. This creates a public record of the estate handover, giving general acknowledgment that you are the new owner of the property. Recording the deed remains fundamental for preserving your claim and preventing any future disputes over ownership. The official costs differ by jurisdiction, so be sure to check with the legal property archives for accurate financial details. Failing to do so could mean legal problems down the line.

Deed templates may provide every property owner help in grasping formal estate agreements. Numerous tools are accessible for virtually all jurisdictions to aid in taking initial steps and be better prepared. When dealing with legal documents, specifically critical forms such as those related to properties, seeking a professional could be beneficial. Such legal arrangements carry legal weight and ensuring accuracy is a priority to prevent disputes.