Printable general warranty deed form 2 oklahoma general warranty deed template example – Ever felt overwhelmed in the maze of technical legal terms during a property title exchange? Deeds, those essential papers that confirm legal possession, may appear overwhelming. Don’t worry! Understanding deeds does not demand a law degree. In this article, we will dive into the world of deeds, and ways for you to initiate the process with a no-cost ownership form to make title transfers easier. The goal is making property transfers much simpler and significantly clearer.

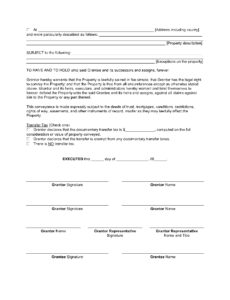

Think of a deed template as your trusty guide within the complex framework of ownership records. Rather than looking at a blank page, overwhelmed, you have a pre-structured document, available for modifications with the specifics of your situation. Think of it as a layout for your legal agreement, helping confirm every important element is accounted for without facing complications in the future.

Nonetheless, bear in mind that using a free deed template requires careful attention. You’ll need to ensure it complies with regional legal conditions and accurately reflects the ownership exchange. We will break down that information shortly, giving you the knowledge to manage this step without hesitation. Let’s break down the fundamentals and guide you toward completing an official ownership transfer.

Structured legal records exist for multiple applications, spanning real estate exchanges (warranty deeds, quitclaim deeds) to creating access rights or creating trusts. This flexibility is fundamental because different legal needs for different ownership transfers may vary greatly. For instance, a warranty deed offers the buyer complete legal backing, confirming rightful property claims and securing against historical ownership issues. In contrast, a simple transfer document only passes along any legal stake the seller has in the property, without assurances. Picking the correct legal format is paramount.

Various deed categories are recognized, each providing varying degrees of security to the grantee. A warranty deed, for instance, ensures maximum coverage, certifying that the original owner possesses valid claim over the real estate and can defend against ownership challenges. Conversely, a quitclaim deed grants the lowest level of assurance, merely conveying whatever interest the grantor has in the land, without formal assurances. Selecting the appropriate property document is fundamental for proper legal recognition of the transaction.

The kind of ownership document chosen is influenced by the nature of the transfer and the degree of security offered to the grantee. Some common types are secured title agreements, quitclaim deeds, and grant deeds. A comprehensive legal agreement ensures maximum security, certifying that the original titleholder possesses legal ownership and the right to pass on the ownership. A quitclaim deed, on the other hand, only passes along any legal stake held by the seller, without any guarantees. This format is typically applied during title exchange within personal relationships or in financial agreements. Understanding the differences between these deed types is crucial in verifying the correct form is applied for your specific situation. Make sure to get proper guidance, or consult experts regarding your transaction.

Before using a no-cost property form, do your research. Make sure it originates from a trusted provider and that it includes every essential detail for your transaction. Don’t forget that legal regulations differ greatly concerning ownership transfer laws. What is legally compliant in one jurisdiction might not be valid in another. Speaking with a qualified attorney or reviewing detailed statutes into your local laws is essential to prevent ownership disputes down the line. A minor expenditure in legal advice upfront could prevent major difficulties later.

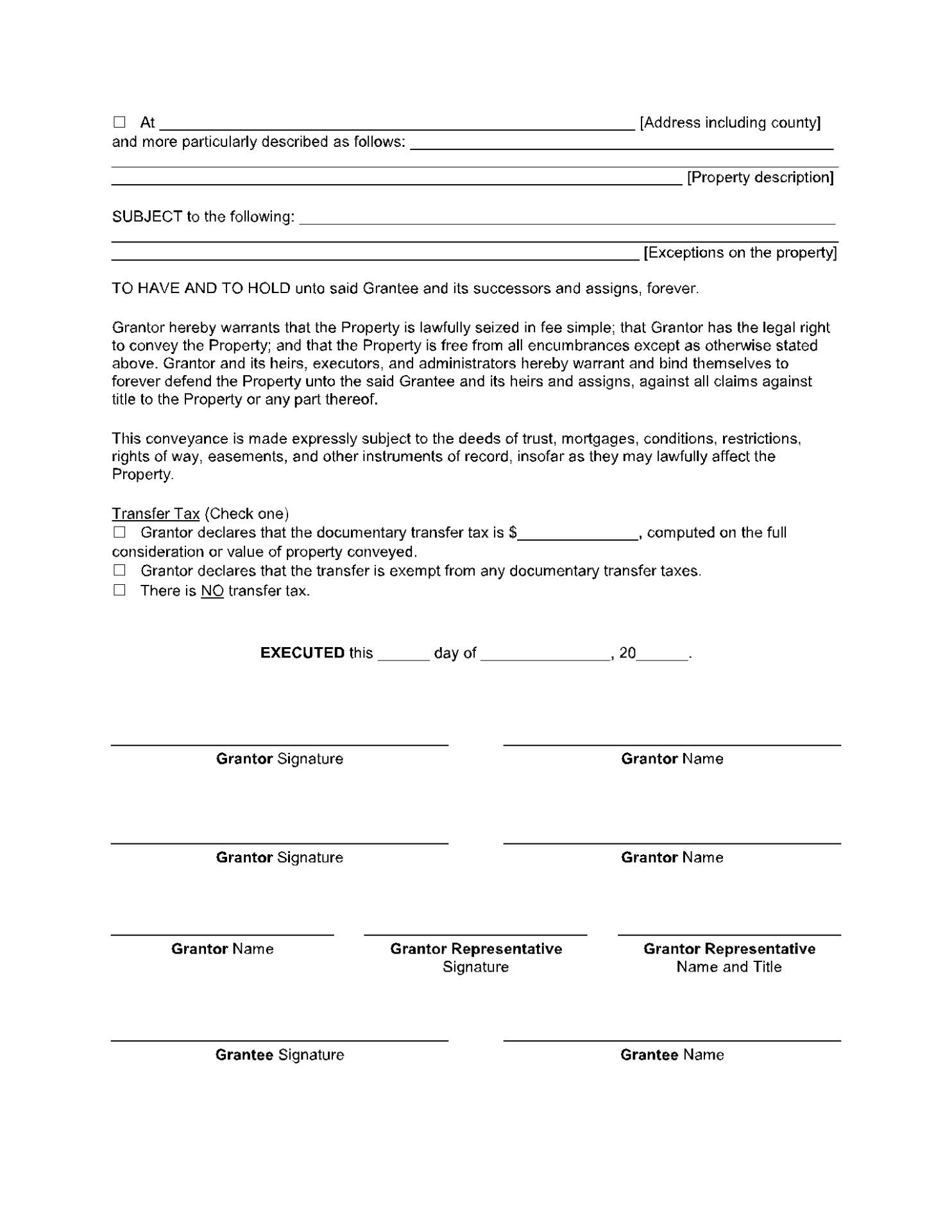

Lastly, understand that merely obtaining an endorsed document isn’t enough. To officially transfer ownership, the title must be entered within the jurisdiction where the property is located. Documenting the ownership agreement confirms official transfer of the transfer and secures the recipient’s entitlements against ownership challenges. The submission method generally includes paying a recording fee and presenting the ownership file to the land title registry. Neglecting to file the document might lead to significant legal complications over time.

A predefined property record grants a simplified and budget-friendly approach to create critical ownership agreements. It avoids the necessity of independent structuring, minimizing your critical hours and effort. Through supplying an organized framework, a deed template confirms that you include every required detail, lowering the possibility of inaccuracies or missing items that might make the document legally void. This proves particularly beneficial for those unfamiliar with legal terminology and proper file structuring.

A crucial factor to take into account is title insurance. Ownership security assurance safeguards the new owner against challenges against the property that might arise from previous complications, including unsettled financial claims, territorial conflicts, or unlawful title shifts. While a warranty deed provides partial security, ownership safeguard adds further protection, making sure that your estate is safely guaranteed. It’s a one-time payment that guarantees long-term security and safeguard your ownership rights for the foreseeable future.

Legal authentication is another critical step within title transfer formulation. A notary public acts as an unbiased observer who confirms the identity of the agreement participant and confirms that the authorization is made freely. Proper notarization is necessary for the ownership agreement to be recorded in the public records, which is essential for establishing clear ownership and protecting your interests. Ensure you understand the legal certification stipulations under your local statutes and adhere to them strictly. Most states require that the property transferor, the individual selling the estate, to be present and identified at the notarization.

The world of property law can seem daunting, yet with proper preparation and the right resources, it is possible to handle the legal procedures effectively. Start by familiarizing yourself with distinct property transfer agreements, grasping the regional regulations, and seeking professional advice whenever required. Resources are available to help you every step of the way, including complimentary property documents to real estate advisors and regulatory agencies. Maintaining awareness and informed is key to a smooth and secure property transfer.

Ultimately, a well-prepared property document, whether structured manually or adapted from a template, holds immense value. It provides clarity, safeguarding, and peace of mind, knowing that your property rights are protected and your specified directives are formally recorded. The impact of a well-executed deed goes further than the specific reassignment, forming a permanent title registry that will support long-term heirs. It stands as proof to the power of documentation and the critical nature of securing your property rights.