Trust deed community trust deed template example – Have you ever been overwhelmed in the maze of legal jargon when trying to transfer property? Legal certificates, these fundamental records that signify ownership, may appear overwhelming. But fear not! Understanding deeds doesn’t require formal legal training. Within this resource, we will dive into the world of deeds, and methods you may begin using a complimentary property document to simplify the transaction. The goal is making property transfers a little less intimidating and a little more accessible.

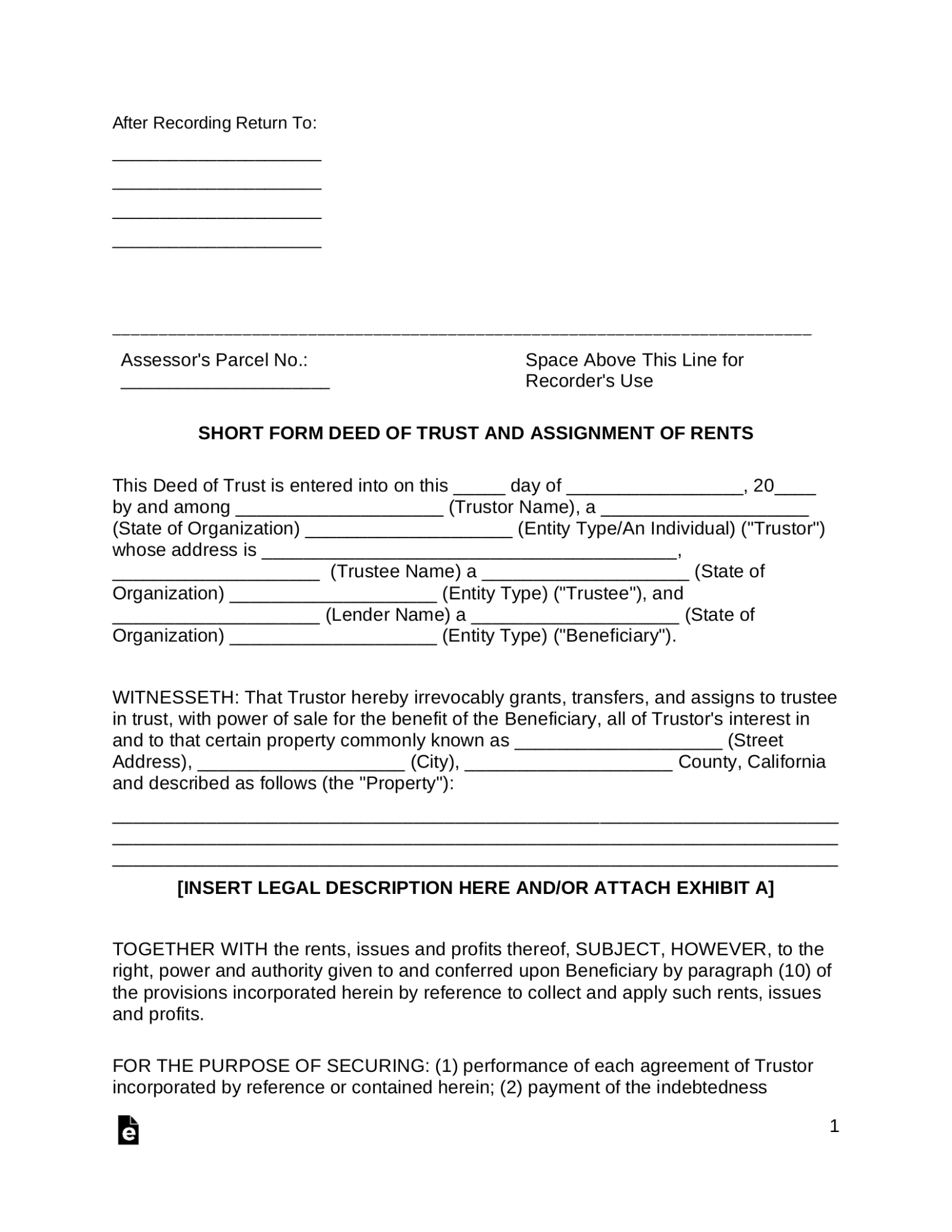

Think of a deed template as a reliable tool through the often-confusing world of real estate contracts. Rather than looking at a completely open document, overwhelmed, you get a ready-made form, prepared for personalized adjustments with the details of your transaction. Consider it a blueprint for your legal agreement, ensuring you cover all the necessary bases and avoid costly mistakes down the line.

This resource does not replace for formal consultation, clearly. Whenever confusion arises, getting guidance from a knowledgeable legal professional or property law expert is the safest approach. However, if you need information to get started, or to familiarize yourself with the procedure, you’ve come to the right place. We will explore the role of a complimentary ownership form may act as a useful base, and what to consider before finalizing it.

A property document is more than just a piece of paper; it functions as an enforceable certificate that officially conveys rights or a stake in an estate, typically real estate. Consider it like a formal deal, except documented officially and legally binding. It officially signifies the transfer of possession from one party (the grantor) to the recipient (the legal claimant). Without a properly executed deed, moving title registration can lead to disputes, or entirely invalid. Imagine this scenario: ownership cannot change hands without documentation.

Various property transfer documents are available, each offering distinct legal guarantees and safeguards. The frequently selected are general warranty deeds, which offer the highest level of security for the recipient, ensuring their claim is safeguarded against any title defects that might have arisen prior to the transferor acquiring the estate. Partial security title transfers provide moderate assurance, ensuring security solely from legal issues that developed while the grantor possessed the property. Conversely, quitclaim transfers lack formal protections and merely convey whatever interest the seller may have in the property. Opting for the best legal agreement is determined by the nature of the property exchange and the degree of liability the new owner is comfortable with.

The significance of precise asset identification is beyond question. Property agreements typically depend upon official property mappings based on surveys, metes and bounds, or parcel identifiers contained in an official listing. An unclear or flawed specification may result in legal conflicts regarding land divisions or ownership. This circumstance demonstrates that depending entirely on a free deed template without verifying legal data can become problematic. Make sure to check the official property details against existing records and when required, request a professional review to validate its legitimacy.

Property transfer agreements typically list key details. These elements are the full identities of the seller and buyer, a well-defined and precise specification of the estate under reassignment, a statement of consideration (detailing the agreed compensation, even if symbolic), along with the transferor’s authorization. The deed must also be properly notarized and recorded in the county records office to provide public notice of the transfer. Not complying to these requirements may void the ownership transfer, resulting in conflicts over time.

Finally, be aware that only possessing an executed agreement isn’t enough. To officially transfer ownership, the document must be filed in the county where the estate is situated. Recording the deed establishes legal acknowledgment of the transaction and safeguards the buyer’s claims against ownership challenges. The submission method generally includes paying a recording fee and officially delivering the legal property form to the municipal archives. Neglecting to file the document might lead to significant legal complications in the future.

A predefined property record offers an efficient and cost-effective way to prepare mandatory title transfers. It eliminates the need to start from scratch, reducing your important effort and administrative challenges. By providing an organized framework, a deed template guarantees that you correctly provide every required detail, reducing the risk of mistakes or missing clauses that might make the document legally void. This proves particularly beneficial for individuals inexperienced with contractual language and document formatting.

After identifying a valid form, thoroughly examine it to verify it includes all the necessary elements. Is there a presence of sections displaying the seller and buyer’s details, the land’s statutory classification, the legal certification of transfer, and the signature and notary blocks? Is it explicitly mentioning the form of property transfer that governs the transaction (such as a secured title agreement or simple ownership shift)? If anything is missing or unclear, it’s advisable to seek an alternative form.

Mistakes in deeds can have serious consequences, possibly threatening the transaction or causing contractual disagreements. Frequent faults involve flawed property definitions, mistakenly written legal names, and absent endorsements. To prevent these mistakes, closely inspect the title transfer before finalizing it and verify that all information is accurate and complete. Reviewing the official property details is especially crucial, as the slightest inaccuracy might make the title unenforceable. If you’re unsure about anything, obtain legal guidance.

Employing a predefined property record can effectively ease the requirements for estate transition. Through choosing an appropriate document, modifying it to fit your situation, and following the proper procedures for validation and registration, you are able to generate an enforceable ownership agreement that secures your claims. Remember, although a structured legal form is a helpful tool, requesting professional consultation if needed is always a wise decision.

Shifting real estate titles should not feel intimidating. Equipped with proper details and tools, you can successfully navigate the process and guarantee a hassle-free and compliant with the law transaction. Dedicating effort to understand the intricacies of deeds and employing thorough verification when selecting and filling out a complimentary ownership form will yield advantages in the future, securing your claims and avoiding ownership disputes.