Keeping track of your financial ins and outs can feel like a daunting task, whether you’re managing a bustling small business, navigating your personal budget, or simply trying to stay on top of daily transactions. It’s easy to get lost in a sea of receipts and numbers, but having a clear, organized system is the key to financial peace of mind. That’s where foundational accounting tools come into play, providing a structured way to record every single event.

One of the most essential and time-tested methods for meticulously documenting these financial activities is through a general journal. And among its various forms, the two-column general journal stands out for its straightforward yet powerful approach to tracking debits and credits. It’s the first step in painting a clear financial picture, ensuring everything is recorded correctly before moving on to more complex ledgers.

Understanding the Essentials of a Two Column General Journal

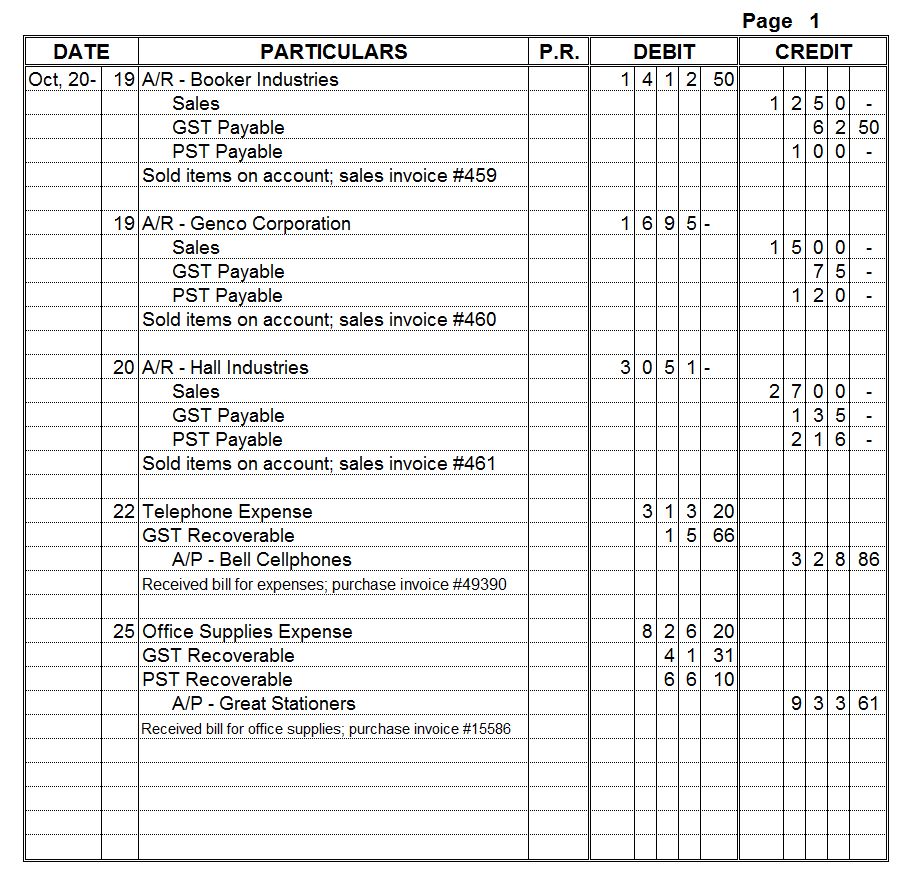

At its core, a general journal is often called the “book of original entry” because it’s where every single business transaction is recorded first, chronologically. Think of it as your daily diary for all things financial. The “two column” aspect specifically refers to the layout of the debit and credit columns, which are central to the double-entry accounting system. This system is based on the fundamental principle that every financial transaction affects at least two accounts, one with a debit and one with a credit, and these must always be equal. It’s a brilliant system for ensuring accuracy and balance in your books.

When you’re dealing with various transactions, from sales and purchases to payments and receipts, having a clear format helps tremendously. A well-designed two column general journal template provides that crucial structure. It ensures that you capture all necessary details for each transaction, making it easier to transfer information to the general ledger later on. This meticulous recording process is not just about compliance; it’s about gaining real insight into where your money is going and coming from.

Key Components Explained

Every effective general journal, especially a two-column one, relies on a set of standardized columns to capture specific details about each transaction. Understanding what each column is for makes the recording process much smoother and more accurate.

- Date: This column is for the exact date the transaction occurred. Accuracy here is vital for chronological record-keeping.

- Account: Here, you list the accounts affected by the transaction. Remember, there will always be at least two accounts involved in a double-entry system.

- Description/Explanation: This space is used to briefly explain the nature of the transaction. For example, “Paid utility bill” or “Cash sale of goods.”

- Post Ref (P.R.): This column is left blank during journalizing. It’s filled in later with the account number from the general ledger when the entry is posted, helping to track what has been transferred.

- Debit: The column where you record the amount of the debit for the affected account(s). Debits increase assets and expenses, and decrease liabilities, equity, and revenue.

- Credit: The column where you record the amount of the credit for the affected account(s). Credits increase liabilities, equity, and revenue, and decrease assets and expenses.

The magic of the two-column system truly shines when you ensure that for every entry, the total amount in the debit column perfectly matches the total amount in the credit column. This balance is your first line of defense against errors, providing an instant check that your transaction has been recorded accurately. A reliable two column general journal template streamlines this process, guiding you through each necessary field so nothing important is missed, effectively setting the stage for organized and reliable financial records.

Why a Two Column General Journal Template is Your Go-To Tool

In today’s fast-paced world, efficiency and accuracy are paramount, especially when it comes to financial management. While the principles of journaling remain constant, the tools we use can significantly impact our productivity and precision. This is precisely where a dedicated two column general journal template becomes an invaluable asset, transforming a potentially complex task into a streamlined, straightforward process. It’s about leveraging structure to simplify your daily accounting needs.

One of the primary advantages of using a template is the sheer consistency it brings to your record-keeping. Imagine trying to create a new layout for every single day’s transactions or for each new client. It would be time-consuming and prone to variations, making it harder to review or audit your records later. A template ensures that every entry, regardless of when it was made or by whom, follows the exact same format, making your entire accounting system cohesive and easy to navigate. This standardization is crucial for clarity and reduces the mental load of remembering column orders or headings.

Beyond consistency, templates are incredible time-savers. You no longer have to worry about drawing lines, writing out column headers, or even remembering the specific order of information needed for each entry. The template has it all laid out for you. This allows you to focus solely on the transaction details themselves, speeding up the entry process significantly. Whether you’re a small business owner with a hundred things on your plate or a student learning the ropes of accounting, saving precious minutes on repetitive tasks can make a huge difference.

Furthermore, a well-structured two column general journal template plays a vital role in enhancing accuracy and minimizing errors. The predefined columns act as a guide, prompting you for all the necessary information, from the date to the specific debit and credit amounts. This structured approach drastically reduces the chances of forgetting a crucial detail or misplacing an amount. The inherent design of the template also reinforces the double-entry accounting principle by visually separating the debit and credit columns, making it clearer that every transaction must have equal and opposite effects. This visual aid reinforces good accounting habits and helps prevent costly mistakes down the line.

Mastering the art of financial record-keeping begins with a solid foundation, and the general journal is undeniably that cornerstone. By consistently using a two column general journal template, you’re not just recording numbers; you’re building a reliable, accurate, and easily understandable financial history for your business or personal finances. This foundational step is crucial for accurate financial reporting, making informed decisions, and ultimately, achieving your financial goals with confidence and clarity.