Thinking about estate planning might feel a bit overwhelming, like trying to untangle a really big ball of yarn. It involves making crucial decisions about your assets, your legacy, and the well-being of your loved ones after you’re gone. While it’s a topic many prefer to put off, getting your affairs in order is one of the kindest things you can do for your family. It ensures your wishes are known and respected, potentially saving them from stress, confusion, and difficult decisions during an already challenging time.

Navigating the ins and outs of wills, trusts, healthcare directives, and power of attorney can seem daunting, but it doesn’t have to be. A fantastic starting point that can simplify this entire process is using an estate planning questionnaire template. This isn’t just a random list of questions; it’s a structured guide designed to help you gather all the necessary information and ponder the important choices you’ll need to make before meeting with an attorney or even just organizing your thoughts for yourself. It acts as a helpful roadmap, ensuring you don’t miss any crucial details.

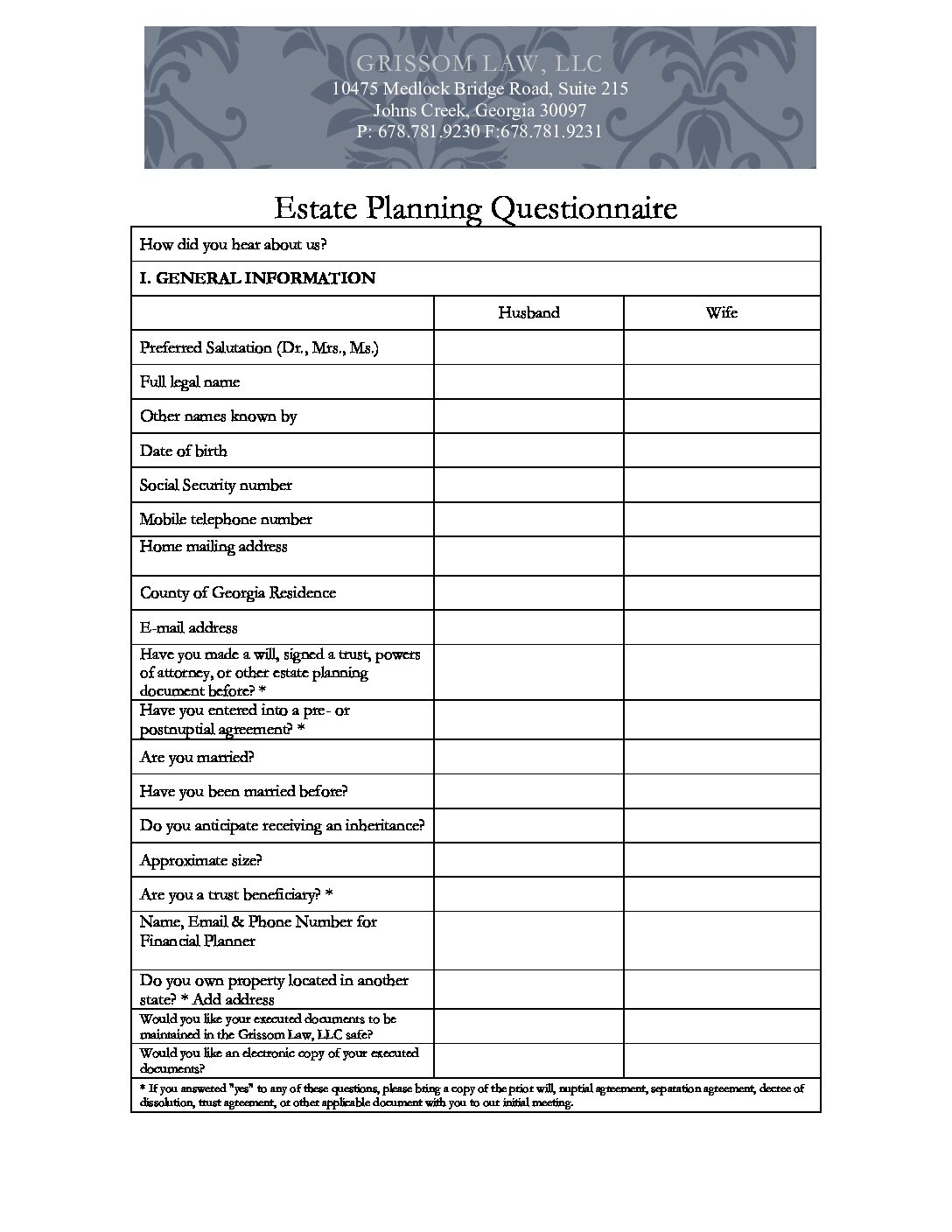

What to Expect When Filling Out an Estate Planning Questionnaire

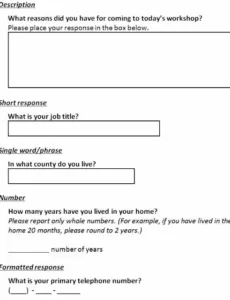

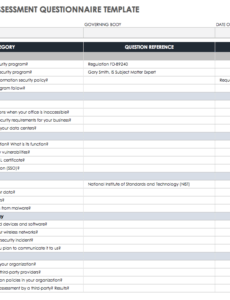

When you sit down with an estate planning questionnaire, you’ll find it’s structured to walk you through various aspects of your personal and financial life. It’s designed to be comprehensive, ensuring that all bases are covered, from the simplest personal details to complex financial arrangements. The goal is to paint a complete picture of your situation, which is essential for creating an estate plan that truly reflects your intentions and protects your loved ones.

Personal and Family Information

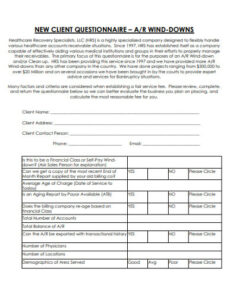

Typically, the initial sections will focus on your personal and family information. This includes basic details like your full name, date of birth, current address, and marital status. If you have a spouse, their details will also be requested. Crucially, you’ll be asked about your children, including their names, dates of birth, and contact information. This foundational information is vital for correctly identifying all parties involved in your estate plan.

Asset Inventory and Liabilities

Moving beyond personal details, the questionnaire will delve deep into your financial landscape. This is where you’ll list all your assets, ranging from real estate properties and bank accounts to investment portfolios, retirement accounts, and even valuable personal property like artwork or jewelry. Don’t forget any business interests you might have. On the flip side, you’ll also be prompted to list your liabilities and debts, such as mortgages, car loans, and credit card balances. Having a clear understanding of both your assets and liabilities is fundamental for proper estate distribution and tax planning.

Distribution Wishes and Healthcare Directives

Perhaps the most thoughtful part of the questionnaire involves your wishes for asset distribution and beneficiary designations. This is where you decide who inherits what. Do you have specific items you want to go to particular individuals? Do you want to leave a percentage of your estate to charity? This section also typically covers crucial healthcare directives, like a living will or medical power of attorney, which specify your wishes regarding medical treatment should you become incapacitated. Similarly, you’ll address financial power of attorney, designating someone to manage your finances if you’re unable to. For those with minor children, nominating a guardian is an incredibly important aspect covered here, ensuring their care and upbringing are in trusted hands. Some questionnaires even touch upon funeral and burial wishes, providing peace of mind to your family.

The Undeniable Benefits of Utilizing an Estate Planning Questionnaire Template

The idea of tackling estate planning can feel daunting, leading many people to procrastinate. However, approaching it with the structured assistance of an estate planning questionnaire template can transform it from an overwhelming task into a manageable project. The benefits are numerous, extending beyond mere organization to significantly improve the entire process for you and your future beneficiaries.

Firstly, these templates are masters of organization and efficiency. Imagine trying to recall every single bank account, investment, and policy number from memory when sitting down with an attorney. It’s incredibly difficult. A questionnaire prompts you to gather all this vital information in one place, systematically. This saves you considerable time, not just in your initial thought process but also in subsequent meetings with legal professionals, as they’ll have a clear, comprehensive overview of your financial and personal situation right from the start. It streamlines the data collection phase, allowing you to focus on the more intricate decisions.

Secondly, a well-designed template ensures comprehensive coverage. It acts as a checklist, guiding you through all the critical areas of estate planning that you might otherwise overlook. From designating guardians for minor children to specifying wishes for digital assets, these templates are built to prompt you on every conceivable detail. This thoroughness helps prevent critical omissions that could lead to complications or disputes for your family down the line. It’s about leaving no stone unturned, guaranteeing that your final estate plan is as robust and complete as possible.

Moreover, using such a template significantly facilitates more productive discussions with your estate planning attorney or financial advisor. When you walk into their office with a completed questionnaire, you’re not just bringing a stack of papers; you’re bringing a pre-thought-out, organized summary of your life. This allows your professional to quickly understand your assets, liabilities, family dynamics, and preliminary wishes. Instead of spending valuable billable hours simply gathering information, your attorney can immediately begin providing tailored advice, exploring options, and drafting documents that truly align with your goals. It transforms the meeting into a strategic planning session rather than an information-gathering one.

Finally, the psychological benefit of using a questionnaire cannot be overstated. It breaks down a complex and potentially emotional topic into smaller, digestible pieces. This step-by-step approach reduces the feeling of overwhelm and stress, making the entire process feel far less intimidating. It empowers you to tackle each section methodically, reflecting on your choices without the pressure of having to figure everything out all at once. It encourages thorough reflection on your legacy and the future of your loved ones, ultimately leading to a more thoughtful and effective estate plan that provides immense peace of mind.

Taking the time to organize your thoughts and information for your estate plan is a truly valuable endeavor. It’s an investment in your peace of mind and the future well-being of those you care about most. By preparing yourself, you ensure that your intentions are crystal clear and that your legacy will be handled precisely as you wish, minimizing stress for your loved ones during a difficult time.

Embracing a proactive approach with a tool like an estate planning questionnaire template sets you on the right path. It’s a powerful first step towards securing your future and providing clarity for your family, offering a sense of calm and control over what happens next. Remember, it’s never too early to start planning, and every detail you put in order now makes a world of difference later.