Embarking on any significant business transaction, be it a merger, acquisition, investment, or even a strategic partnership, involves a considerable leap of faith. You’re essentially putting your trust and resources into another entity, and before you do, it’s absolutely critical to get the full picture. This is where the meticulous process of due diligence comes into play, serving as your essential compass to navigate potential pitfalls and uncover valuable insights.

At its core, due diligence is about gathering and verifying information to make an informed decision. But imagine trying to do this from scratch every single time, without a structured approach. It would be chaotic, inefficient, and prone to overlooking crucial details. This is precisely why having a well-crafted framework, like a due diligence questionnaire, becomes an indispensable tool for any discerning investor or business leader.

Why a Due Diligence Questionnaire Template is Your Essential Tool

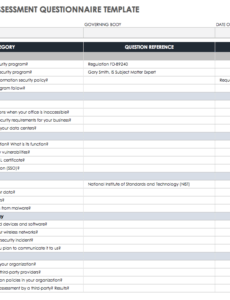

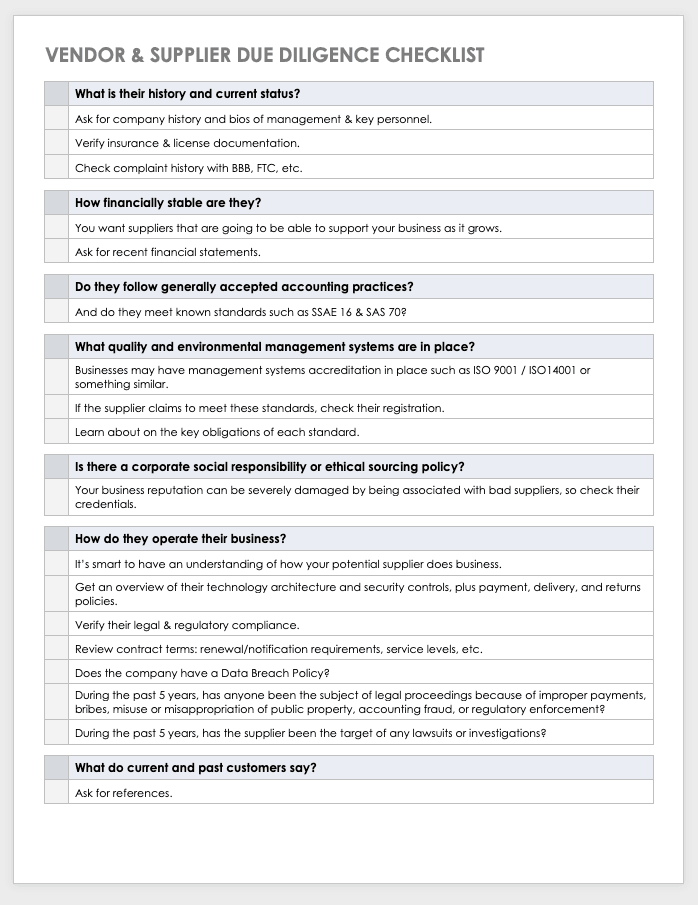

Think of a due diligence questionnaire template as your personal blueprint for investigative success. It’s not just a list of questions; it’s a systematic guide designed to ensure that no stone is left unturned when evaluating a potential opportunity. Having a pre-defined structure dramatically streamlines the entire process, saving valuable time and resources that would otherwise be spent on formulating questions from scratch for each unique situation. This standardization also means that you’re consistently applying the same level of scrutiny, leading to more reliable and comparable results across different projects.

Beyond mere efficiency, a robust template significantly enhances the comprehensiveness of your due diligence efforts. It acts as a comprehensive checklist, reminding you of all the critical areas that need to be explored, from financial health and legal standing to operational capabilities and environmental impact. Without such a guide, it’s incredibly easy for blind spots to emerge, potentially leading to costly surprises down the line. It ensures that your team, or external advisors, are all working from the same playbook, ensuring consistency in the information requested and received.

Perhaps most importantly, a due diligence questionnaire template is a powerful risk mitigation tool. By systematically probing into various aspects of the target entity, you significantly increase your chances of identifying red flags, undisclosed liabilities, or potential deal-breakers early in the process. Uncovering these issues proactively allows you to either negotiate better terms, adjust your valuation, or even walk away from a bad deal before significant capital or effort is expended. It transforms a potentially reactive situation into a proactive and controlled one.

Furthermore, while a template provides structure, it’s inherently flexible. It serves as a solid foundation that can be easily customized to fit the specific nuances of your particular transaction. Whether you’re looking at a tech startup, a manufacturing firm, or a service-based business, a good template allows for easy adaptation, ensuring that the questions are relevant and targeted to the industry, size, and nature of the deal. This adaptability is key to maintaining relevance without sacrificing the benefits of standardization.

Key Areas a Template Should Cover

To be truly effective, a comprehensive due diligence questionnaire template typically delves into several core areas, ensuring a holistic view of the target entity. These sections are designed to provide a deep dive into every facet of the business.

- Legal and Corporate Matters: This includes reviewing incorporation documents, ownership structure, existing contracts, litigation history, intellectual property, and regulatory compliance.

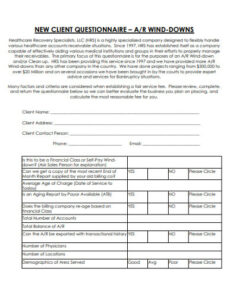

- Financial Health: A thorough examination of financial statements (balance sheets, income statements, cash flow), tax returns, debt obligations, asset valuations, and revenue recognition policies.

- Operational Insights: Understanding the day-to-day operations, supply chain, customer base, sales processes, IT infrastructure, and major operational agreements.

- Human Resources: Assessing organizational structure, key personnel, compensation plans, employee agreements, benefits, and any potential labor disputes.

- Environmental, Social, and Governance (ESG): Investigating environmental compliance, social impact, governance practices, and any associated risks or opportunities.

- Market and Commercial Standing: Analyzing market position, competitive landscape, growth opportunities, and customer relationships.

Effectively Leveraging Your Due Diligence Questionnaire Template

Having a high-quality due diligence questionnaire template is a fantastic starting point, but its true power lies in how effectively it’s utilized and adapted to each unique scenario. The first step is always to review the template thoroughly and tailor it to the specific nature of the transaction. For instance, if you’re acquiring a software company, you’ll want to place a much heavier emphasis on intellectual property, data security, and development processes than if you were buying a traditional retail business. This customization ensures that your efforts are focused on the most relevant areas of risk and value.

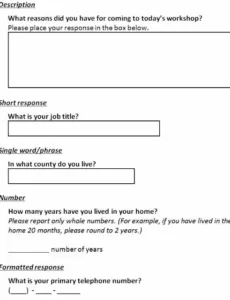

Once your template is customized, ensure that the questions are clear, unambiguous, and directly relevant to the information you need. Avoid vague phrasing that could lead to imprecise or incomplete answers. It’s also crucial to involve all key stakeholders from your own team – legal advisors, financial experts, operational managers, and HR specialists – in both the customization of the questionnaire and the review of the responses. Their diverse perspectives will help identify gaps and provide deeper insights into the information gathered.

As responses start coming in, treat them not just as answers, but as starting points for further investigation. A well-answered question might lead to five more detailed follow-up questions. Be prepared to ask for supporting documentation for every claim made and every number provided. This diligent cross-referencing and verification process is what transforms raw data into actionable intelligence. Remember, the goal is not just to collect information, but to understand its implications for your potential investment or partnership.

Finally, consider the due diligence process as an iterative one. Information gleaned from one section might shed light on another, requiring you to revisit earlier questions or add new ones. Maintain clear communication channels with the target company, being respectful of their time while firm in your requests for information. A well-managed and thorough due diligence phase, guided by a robust template, significantly increases your chances of a successful and mutually beneficial outcome.

The disciplined application of a structured information-gathering process like due diligence is paramount for anyone navigating complex business transactions. It’s the difference between stepping into an opportunity with eyes wide open and making a blind leap. By meticulously evaluating every facet of a potential deal, you empower yourself with the knowledge needed to make sound, strategic decisions that protect your interests and foster long-term success.

Ultimately, investing the time and effort upfront into comprehensive analysis pays dividends by mitigating unforeseen risks and uncovering true value. It ensures that every decision is backed by solid data, leading to outcomes that are not just profitable, but also sustainable and aligned with your broader strategic objectives.