Navigating the complex world of regulatory compliance can feel like walking through a dense jungle. Every path seems to lead to a new rule, a new standard, or a potential pitfall. For any organization, regardless of size or industry, understanding and mitigating compliance risks isn’t just a good idea, it’s an absolute necessity for survival and sustained growth. The stakes are high, ranging from hefty fines and legal battles to irreparable damage to your brand reputation.

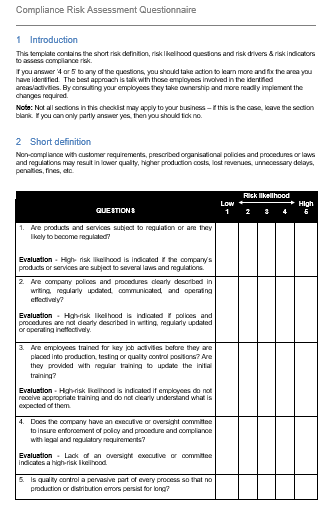

But how do you even begin to systematically identify, evaluate, and address these risks? The answer lies in a structured approach, and a powerful tool in that arsenal is a well-designed compliance risk assessment questionnaire template. It provides a methodical framework to uncover vulnerabilities, ensuring you don’t overlook critical areas and can build a robust defense against potential compliance failures.

Why a Structured Approach to Compliance Risk is Non-Negotiable

In today’s ever-evolving regulatory landscape, simply reacting to compliance issues as they arise is a recipe for disaster. A proactive, structured approach to compliance risk assessment allows your organization to identify potential threats before they escalate into major problems. This isn’t just about avoiding penalties; it’s about safeguarding your operational integrity, protecting your customer data, and maintaining the trust of your stakeholders. Without a clear methodology, risks can easily slip through the cracks, leaving your organization exposed to significant financial and reputational harm.

Think of it as building a strong foundation for your entire business. Each brick represents a compliance control, and a thorough assessment ensures that every brick is in place and strong enough to withstand pressure. This proactive stance enables leadership to make informed decisions about resource allocation, training needs, and the implementation of new policies and procedures. It shifts the mindset from reactive firefighting to strategic foresight, embedding compliance into the very fabric of your organizational culture.

Furthermore, a comprehensive risk assessment aids in demonstrating due diligence to regulators. When an incident occurs, showing that you had a robust process in place to identify and mitigate risks can significantly influence the outcome. It proves that you’re serious about your obligations and committed to upholding the highest standards. This level of transparency and accountability is invaluable in today’s scrutinized business environment.

The beauty of leveraging a compliance risk assessment questionnaire template lies in its ability to standardize this complex process. It ensures consistency in data collection across different departments or business units, making it easier to aggregate information, spot trends, and prioritize risks based on their likelihood and potential impact. It transforms what could be a chaotic, inconsistent effort into an organized, actionable framework for risk management.

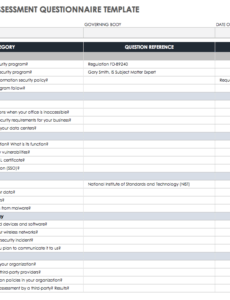

Key Components of a Comprehensive Compliance Risk Assessment Questionnaire

- Regulatory Framework Identification: Questions to identify all applicable laws, regulations, industry standards, and internal policies relevant to the organization’s operations.

- Risk Area Categorization: Sections dedicated to specific compliance domains, such as data privacy (GDPR, CCPA), anti-money laundering (AML), environmental regulations, anti-bribery and corruption (FCPA, UK Bribery Act), labor laws, and financial reporting.

- Likelihood and Impact Assessment: Questions designed to gauge the probability of a risk occurring and the potential severity of its consequences (financial, reputational, operational) if it does.

- Existing Controls Evaluation: Inquiries about current controls, policies, procedures, and training programs in place to mitigate identified risks, assessing their effectiveness and maturity.

- Residual Risk Calculation: Prompts to determine the level of risk remaining after current controls are considered, leading to prioritization.

- Action Plan and Ownership: Spaces to outline specific remediation steps, assign responsibilities, set deadlines, and track progress for unmitigated or high-priority risks.

- Documentation and Review Process: Questions ensuring that all assessments are properly documented, regularly reviewed, and updated as circumstances or regulations change.

Developing and Deploying Your Compliance Risk Assessment Questionnaire

Creating an effective compliance risk assessment questionnaire template isn’t a one-size-fits-all endeavor. While a template provides an excellent starting point, its true value comes from tailoring it to your organization’s unique operational landscape, industry, and the specific regulatory environment in which you operate. Begin by clearly defining the scope of your assessment. Are you evaluating risks across the entire enterprise, or focusing on a particular department, product, or geographical region? This clarity will inform the types of questions you need to include and the level of detail required for each.

Engage key stakeholders from various departments early in the development process. Their insights are invaluable for identifying specific risks relevant to their functions and for understanding the practical implications of proposed controls. Legal, IT, HR, finance, and operational teams all have unique perspectives on potential compliance vulnerabilities. Their collaboration ensures the questionnaire is comprehensive, practical, and fosters a sense of shared ownership over the compliance program.

Once your template is developed, the deployment phase requires careful planning. Communicate the purpose and importance of the assessment clearly to all participants. Provide thorough instructions and, if necessary, training on how to accurately complete the questionnaire. Emphasize that the goal is to identify areas for improvement, not to assign blame. A supportive and non-punitive environment encourages honest and accurate responses, which are crucial for a truly effective risk assessment.

Remember that compliance risk assessment is an ongoing process, not a one-time event. Regulatory landscapes evolve, business operations change, and new technologies introduce new risks. Therefore, your compliance risk assessment questionnaire template should be a living document, subject to regular review and updates. Schedule periodic re-assessments, typically annually or whenever significant organizational changes occur, to ensure your risk management strategy remains current, effective, and resilient against emerging threats.

By systematically utilizing a robust questionnaire, organizations can move beyond merely reacting to compliance challenges. They gain the foresight to anticipate potential issues, strategically allocate resources, and build a proactive compliance culture that permeates every level of the business. This structured approach fosters a deeper understanding of risks, leading to more effective controls and a stronger, more resilient operational framework.

Ultimately, investing in a comprehensive assessment process, anchored by a thoughtfully designed template, empowers your organization to not only meet its regulatory obligations but to transform compliance from a burden into a competitive advantage, ensuring long-term stability and sustainable growth in a complex global marketplace.