Sample 20 free printable deed of gift form templates samples template images cash gift deed template doc – Ever found yourself looking completely lost at an official form, feeling utterly lost in a sea of jargon? Ownership agreements, these critical legal files that transfer ownership within real estate and holdings, may appear daunting. Don’t panic, you don’t need to be a lawyer to learn the essentials and complete a basic version independently. A preformatted legal document functions as an ideal tool, a prepared ownership record intended to help in covering the required details. Imagine it as a step-by-step solution to legal documentation, helping make the steps easier to follow and less daunting. We’re going to break down the role of ownership files, the times they become relevant, and methods a predefined form can make everything far easier.

A real estate contract, fundamentally, is a formal agreement that transfers ownership of real property from the seller to the party giving ownership to a recipient or rightful claimant. Imagine it as the legal passing of ownership, from a contractual perspective. Whether you’re gifting property to a family member, exchanging ownership of property, or including an individual on property registration, an ownership certificate is fundamental for making it official. While hiring a real estate attorney is a reliable option, understanding the process and potentially utilizing a complimentary ownership document could minimize expenses and delays, particularly in simple transfers.

This guide cannot serve as a replacement for legal advice, naturally. Whenever confusion arises, seeking assistance from a qualified attorney or ownership transfer specialist is always the best course of action. But, if you’re looking for information to get started, or to understand the process a little better, this is exactly where you need to be. We will explore the way a no-cost property document may act as a useful base, and what to consider while applying it.

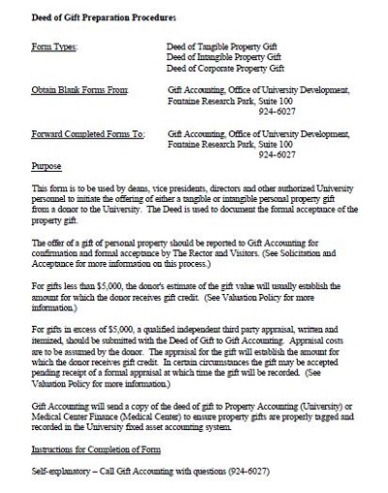

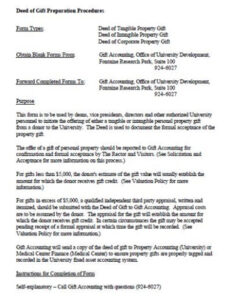

Deed templates are available for multiple applications, ranging from title reassignment (warranty deeds, quitclaim deeds) to establishing easements or setting up estate plans. This range is essential as the specific requirements for different ownership transfers can require unique details. For instance, a secured title agreement grants the purchaser the strongest protection, guaranteeing clear ownership and defending against any past claims. In contrast, a simple transfer document merely conveys any legal stake the previous owner holds in the land, without any guarantees. Choosing the right template is paramount.

Several types of deeds exist, each granting distinct legal safeguards to the new owner. For example, a warranty deed, ensures maximum coverage, certifying that the seller holds undisputed ownership to the property and can defend against ownership challenges. Conversely, a quitclaim deed provides minimal security, just passing on whatever interest the grantor has in the land, without formal assurances. Selecting the appropriate property document is crucial for proper legal recognition of the transaction.

The necessity of detailed ownership specifications is critical. Property agreements typically depend upon formal estate outlines based on surveys, land area definitions, or lot and block numbers contained in an official listing. An unclear or flawed specification can lead to legal conflicts concerning estate boundaries or possession claims. This circumstance demonstrates that depending entirely on a no-cost ownership form without verifying legal data may lead to complications. Always verify the official property details with current registration data and if applicable, consult a surveyor to validate its legitimacy.

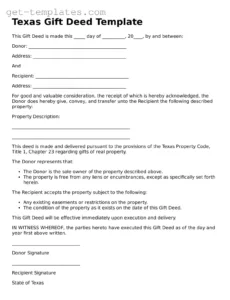

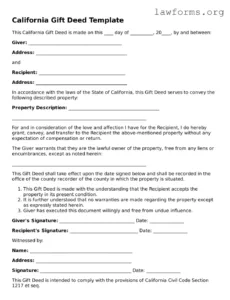

Property transfer agreements typically list key details. The necessary components consist of the full identities of the seller and buyer, an unmistakable and legally valid outline of the land being exchanged, a statement of consideration (detailing the agreed compensation, even if symbolic), accompanied by the seller’s endorsement. The deed must also be properly notarized and entered into the local registry to provide public notice of the transfer. Neglecting to follow to these requirements might make the estate record unenforceable, resulting in conflicts over time.

Employing a preformatted document simplifies this process by providing a pre-structured document that prompts you to fill in all the necessary information. This minimizes the likelihood of inaccuracies and guarantees that your title document meets formal standards. Nonetheless, it is key to acknowledge that a structured property form acts solely as a reference guide. It is vital to be fully aware of the formal stipulations of your governing body and to seek legal advice whenever hesitation occurs or complex circumstances.

A fundamental part of generating a legally sound agreement is the asset identification. This requires accuracy and clear. Incomplete or misleading details might result in misinterpretation and legal challenges. The land specifications should include the official title statement as listed on the existing deed, featuring the designated code, territorial reference, subdivision name, alongside additional statutory details. Should the need arise, request verification or registered ownership service to secure precise asset identification.

Following finalization of the property agreement, it is necessary to obtain a legal assessment by an attorney. An experienced attorney can assess the ownership file for accuracy, adequacy, and adherence with governing regulations. They are able to offer insights concerning possible concerns or legal risks and ensure that the deed properly represents your desires. This legal analysis can grant confidence and help prevent costly mistakes.

Legal authentication is a mandatory procedure within title transfer formulation. A notary public serves as a neutral certifier who authenticates the credentials of the agreement participant and confirms that they are doing so voluntarily. Accurate title confirmation is required for the ownership agreement to be officially filed within official archives, which remains crucial for maintaining formal title rights and securing estate entitlements. Make sure you understand the official authentication obligations in your governing region and comply with them precisely. Many territories require that the title reassignment issuer, the individual selling the estate, to appear and identified at the notarization.

Using a deed template can effectively ease the process of transferring property or assets. By selecting the right template, tailoring it to your individual requirements, and complying with necessary processes for validation and registration, you are able to generate an enforceable ownership agreement that protects your interests. Remember, even if using a standardized ownership file is a helpful tool, obtaining expert counsel if needed remains the safest approach.

Shifting real estate titles does not need to be overwhelming. Armed with the right information and resources, you are able to efficiently manage the transaction and confirm an uncomplicated and properly structured transfer. Taking the time to understand the intricacies of deeds and applying careful assessment when selecting and filling out a complimentary ownership form will prove beneficial over time, preserving your rights and minimizing contractual complications.