Arizona transfer on death deed or tod beneficiary deed for husband arizona beneficiary deed template – Do you sometimes find yourself needing a legally binding document but struggling by the challenging structure of technical terminology? You’re not alone. Deeds, those seemingly ancient scrolls of property ownership and agreements, are essential in various real estate dealings. No need to worry! Professional legal training isn’t necessary to draft a deed. Here’s why a good deed template comes in handy, an essential framework to make sure you follow the correct process.

If you’re donating real estate to a family member, selling an estate, or just modifying title details, the right documentation is crucial. Finding the right document and confirming it is correctly completed is necessary for a seamless transition. Navigating the legal landscape can feel complex, yet we’re ready to help. We will simplify the details, explaining what a deed is, the different types you may need, along with sources for obtaining guides to support your journey.

This guide cannot serve as a replacement for formal consultation, clearly. When in doubt, seeking assistance from an experienced lawyer or real estate professional is the safest approach. Yet, if you want information to get started, or to gain a clearer understanding of the steps, you’ve come to the right place. We will explore the role of a complimentary ownership form can be a helpful starting point, and things to keep in mind while applying it.

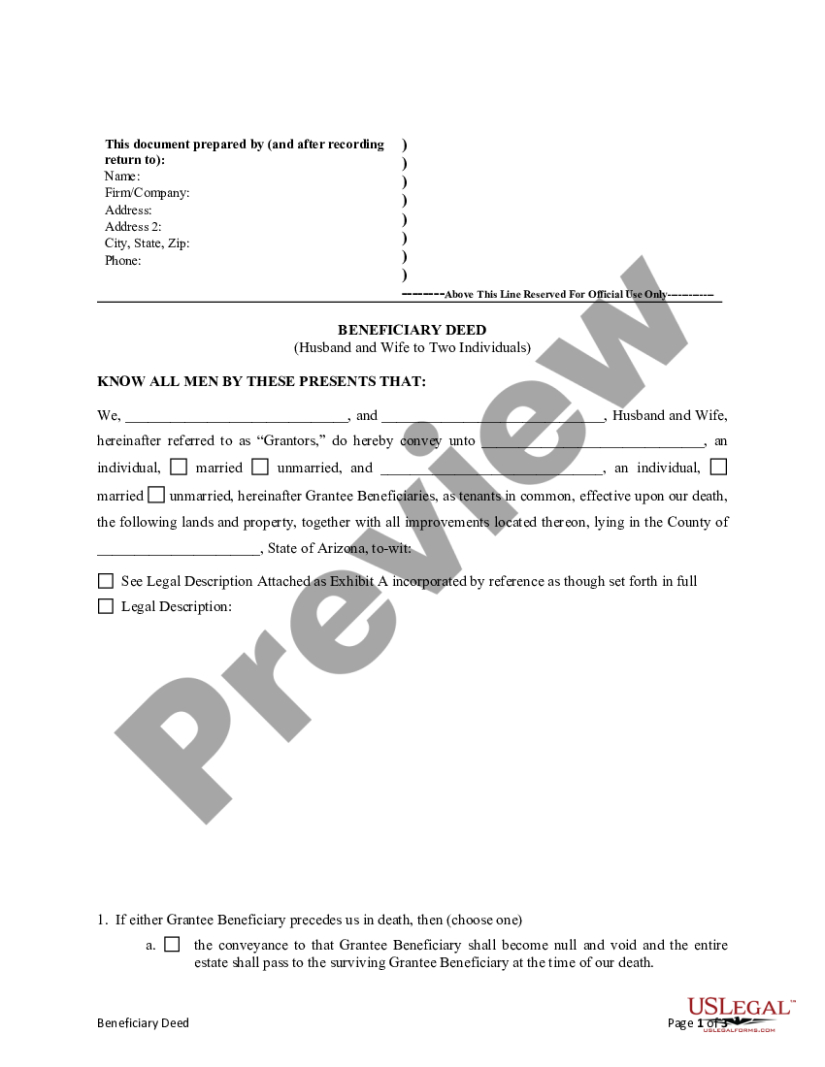

Deed templates are available for multiple applications, ranging from title reassignment such as secured title agreements and informal claims to creating access rights or securing financial holdings. This range is crucial because different legal needs for varying property documents can differ significantly. Take this case: a warranty deed grants the purchaser maximum security, confirming rightful property claims and securing against historical ownership issues. On the other hand, a quitclaim deed merely conveys any legal stake the current titleholder possesses in the estate, without any guarantees. Choosing the right template is paramount.

There are several types of deeds, each providing distinct legal guarantees and assurances. The widely used are general warranty deeds, which offer the strongest legal backing to the buyer, securing their legal rights from potential ownership disputes that may have existed before the grantor had legal possession. Limited coverage ownership documents grant partial legal protection, restricting coverage to from legal issues that developed during the seller’s ownership. Unlike warranty agreements, quitclaim forms provide zero assurance and merely convey the available ownership rights in the property. Selecting the right type of deed is influenced by the details of the title transfer and the amount of uncertainty the new owner is comfortable with.

Despite the availability of a predefined estate form can be incredibly helpful, it remains essential to keep in mind that it cannot serve as an alternative for professional consultation. All property transactions is unique, and it’s always best to consult with an attorney to confirm that the template is suitable for your specific needs and that you understand the legal implications of the document. A lawyer can also help your document modifications to address any distinct situations or legal considerations. This remains highly necessary in managing detailed real estate transactions or highly structured ownership documents.

So, when might you need a deed? Typical instances involve purchasing or disposing of real estate, transferring property between family members, handing over an estate, adding or removing someone from the title, and securing assets within a legal framework. Under any of these conditions, a properly executed deed is essential to legally transfer ownership. Using a free deed template may serve as a budget-friendly option, but it’s critical to verify that the form you apply is legally valid for your transaction and adheres with relevant regulations.

In the end, a complimentary ownership document can be a useful tool for recognizing the elements of a deed and getting a general sense of how the transaction works. However, it is not meant to be a substitute for expert attorney consultation, or state-specific deed forms. Think of it as an initial framework for your understanding, and never overlook exactness and compliance with every governing statute. Employing a predefined document without properly acknowledging its legal effects can lead to errors, transaction hold-ups, or potential disputes.

One of the most critical aspects of generating a legally sound agreement is the asset identification. This requires accuracy and legally definitive. Vague or inaccurate descriptions can lead to misinterpretation and ownership disputes. The land specifications needs to feature the official title statement as registered on the existing deed, including the lot number, sectioned division, area designation, alongside additional statutory details. If necessary, request verification or legal documentation entity to secure precise asset identification.

Once you’ve found a suitable document, carefully review it to verify it features all the necessary elements. Is there a presence of fields for the grantor and grantee’s names, the estate’s official definition, the statement of conveyance, and the signature and notary blocks? Does it clearly state the type of deed being used (e.g., warranty deed, quitclaim deed)? If mandatory sections are incomplete or confusing, it’s advisable to seek another document.

Be aware that a free deed template is just a starting point. You’ll need to customize it to fit your specific situation. Ensure all sections are completed accurately and completely. Verify the land’s registered specifications against existing records. Make sure that both the grantor and grantee’s names are entered exactly as required. If you’re unsure regarding any section of the document, seek advice to a property specialist or certified lawyer.

The landscape of ownership legislation might feel complicated, but with careful planning and appropriate guidance, it is possible to handle the transaction smoothly. Start by familiarizing yourself with various ownership documents, grasping the regional regulations, and requesting specialized guidance should uncertainty arise. Helpful tools exist to help you every step of the way, such as no-cost ownership forms to attorneys and title companies. Maintaining awareness and knowledgeable is key to a smooth and secure property transfer.

Reallocating ownership doesn’t have to be daunting. Armed with the right information and references, you are able to efficiently manage the transaction and ensure a hassle-free and properly structured exchange. Investing energy to explore the complexities of title documents and exercising due diligence when selecting and filling out a complimentary ownership form will yield advantages in the future, preserving your rights and preventing future legal headaches.