Navigating the world of financial record-keeping can sometimes feel like trying to solve a complex puzzle, especially when you’re dealing with numerous transactions and trying to keep everything in order. Whether you’re running a small business, managing personal finances, or just starting to learn the ropes of accounting, having clear, organized tools is absolutely essential. These tools not only help in tracking where your money goes but also provide valuable insights into your financial health.

Two of the most foundational and powerful tools in this journey are the general journal and the accounting worksheet. They work hand-in-hand to ensure that every financial event is meticulously recorded, categorized, and summarized. Understanding how to effectively use them, especially through a well-designed accounting worksheet general journal template, can transform your financial management from a chore into a clear, insightful process.

Understanding the Core Components: General Journal and Accounting Worksheet

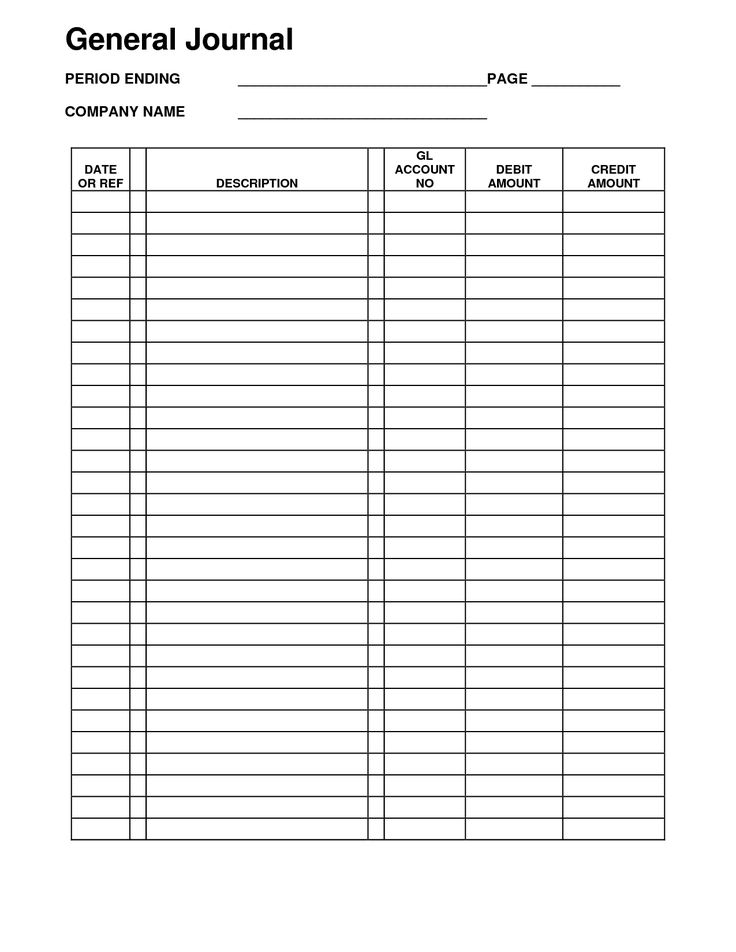

At the heart of any robust accounting system lies the general journal. Think of it as your business’s financial diary, where every single transaction is recorded chronologically, as it happens. This “book of original entry” ensures that there’s a complete, date-ordered history of all financial events, from a simple cash sale to a complex equipment purchase. Each entry typically details the date, the accounts affected (debit and credit), and a brief explanation of the transaction. This meticulous record-keeping is vital for maintaining accuracy and provides an indispensable audit trail.

The general journal isn’t just about recording; it’s about setting the foundation for all subsequent financial analysis. By consistently applying the double-entry accounting system, where every debit has a corresponding credit, the general journal inherently helps to maintain the balance of the accounting equation. Without this initial, detailed recording, any further financial statements would be unreliable. It captures the story of your business’s financial activities day by day, moment by moment.

The General Journal: Your Financial Diary

- Date: When the transaction occurred.

- Account Titles and Explanations: The specific accounts impacted and a brief description.

- Debit: The amount debited to one or more accounts.

- Credit: The amount credited to one or more accounts, always balancing with the debits.

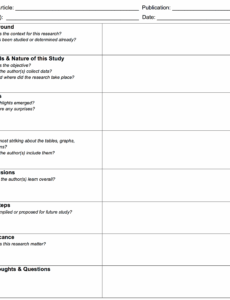

Moving beyond the initial recording, the accounting worksheet steps in as a powerful internal tool. While the general journal captures individual transactions, the worksheet is designed to organize and summarize all that data, typically at the end of an accounting period. It’s a non-formal document, meaning it’s not shared externally, but it’s incredibly valuable for accountants and business owners alike. Its primary purpose is to aid in the preparation of financial statements, ensuring that all accounts are balanced and adjustments are properly made before formal statements like the income statement and balance sheet are drafted.

The worksheet typically presents financial data in a structured, multi-column format, allowing you to move from an unadjusted trial balance through necessary adjustments, to an adjusted trial balance, and finally to categorizing accounts for the income statement and balance sheet. This systematic approach helps in identifying errors, applying accruals and deferrals, and ultimately ensuring the accuracy of your final financial reports. It’s a crucial step that bridges the gap between raw transaction data and polished financial insights.

The Accounting Worksheet: A Financial Blueprint

- Unadjusted Trial Balance: Initial balances of all accounts.

- Adjustments: Entries for accruals, deferrals, depreciation, etc.

- Adjusted Trial Balance: Account balances after adjustments.

- Income Statement: Revenue and expense accounts from the adjusted trial balance.

- Balance Sheet: Asset, liability, and equity accounts from the adjusted trial balance.

Bringing It All Together: Why an Accounting Worksheet General Journal Template Matters

The true power emerges when these two essential tools are integrated or streamlined through a comprehensive accounting worksheet general journal template. Such a template isn’t just a basic form; it’s a structured framework that guides you through the entire accounting cycle, from initial transaction entry to the preparation of summarized financial data. By providing a consistent and organized layout, a good template simplifies complex accounting tasks, making them accessible even to those without extensive accounting backgrounds. It’s about creating a smooth, error-resistant flow for your financial data.

One of the most significant advantages of utilizing a template is the immense efficiency it brings. Instead of manually setting up new formats for each accounting period or for every type of transaction, a pre-designed template allows for rapid data entry and automatic calculations, depending on its sophistication. This not only saves valuable time but also drastically reduces the potential for human error. Consistent formatting across all your records makes it easier to track trends, compare periods, and prepare for critical activities like tax filing or year-end reviews.

Furthermore, an effective accounting worksheet general journal template serves as an invaluable educational resource. For new students of accounting or small business owners venturing into financial management for the first time, seeing the structured progression from journal entries to the various columns of the worksheet can demystify the entire process. It provides a tangible example of how debits and credits flow through the system and how adjustments impact final financial figures, building a solid understanding of fundamental accounting principles.

Ultimately, a robust accounting worksheet general journal template is more than just a document; it’s a strategic asset for financial clarity and control. It empowers you to maintain meticulous records, gain clear insights into your business’s performance, and make informed decisions based on accurate data. Whether you choose a simple spreadsheet-based template or a more advanced digital solution, the core benefit remains the same: a systematic approach to managing your finances that fosters accuracy, efficiency, and confidence.

Benefits of Using a Template

- Streamlined Data Entry: Consistent format for quick recording.

- Enhanced Accuracy: Reduces manual errors through structured fields.

- Time-Saving Workflow: Speeds up the accounting cycle process.

- Improved Consistency: Ensures uniform record-keeping across periods.

- Easier Learning Curve: Simplifies complex accounting for beginners.

Mastering the general journal and the accounting worksheet is foundational for anyone serious about sound financial management. These tools, working in tandem, provide an unparalleled level of detail and summary, allowing you to not only track where every dollar goes but also understand the broader financial picture of your endeavors. They are not merely tasks to be completed but instruments for gaining control and clarity over your economic activities.

By embracing the power of these fundamental accounting components, you equip yourself with the ability to maintain organized records, derive meaningful insights, and make well-informed decisions. This meticulous approach to financial data ensures you are always aware of your financial standing, paving the way for sustainable growth and a profound sense of peace regarding your monetary well-being.