Navigating the world of commercial insurance can often feel like piecing together a complex jigsaw puzzle, especially when you are trying to ensure every aspect of your business is adequately protected. With so many variables to consider, from your daily operations to potential unforeseen risks, it is easy to feel overwhelmed. Securing the right coverage isn’t just about ticking a box; it is about building a robust safety net that safeguards your hard work and future aspirations.

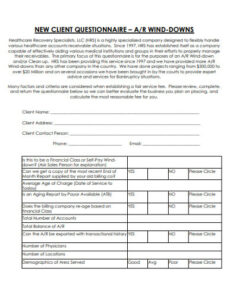

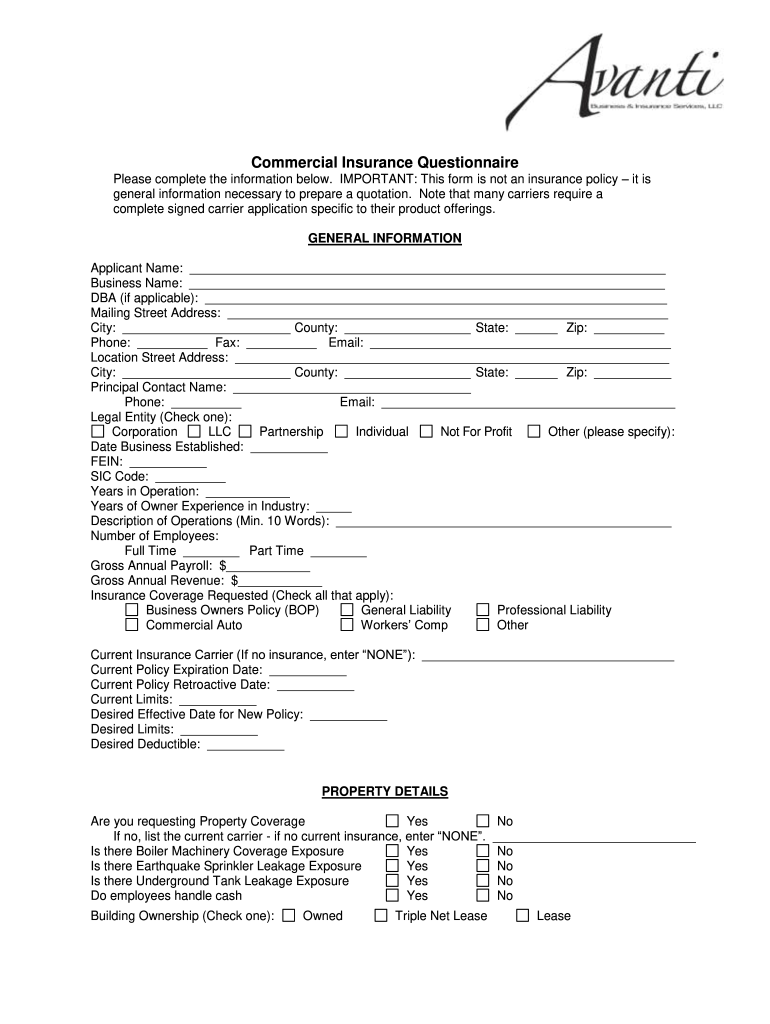

This is precisely where a well-structured commercial insurance questionnaire template becomes an invaluable asset. It serves as a comprehensive tool designed to streamline the information gathering process, ensuring that you provide your insurance broker or provider with all the necessary details to secure the most fitting and competitive policies. Think of it as your cheat sheet to clear communication and ultimately, tailored protection.

Why a Commercial Insurance Questionnaire Template Is Your Best Friend

In the bustling world of business, efficiency and accuracy are paramount. A well-designed commercial insurance questionnaire template acts as a central hub for all the critical information an insurer needs to assess your risks and provide accurate quotes. It eliminates guesswork and ensures that no vital piece of data is overlooked, which can be the difference between adequate coverage and significant gaps. For business owners, it simplifies the often daunting task of compiling data, turning a potentially chaotic process into a structured, manageable one. For insurance professionals, it means receiving complete information upfront, leading to faster, more precise quotes and less back-and-forth communication.

Beyond just efficiency, using a template fosters a deeper understanding of your business’s risk profile. As you go through each question, you are prompted to think about various facets of your operations that you might not typically consider from an insurance perspective. This can uncover potential exposures or areas where your current practices might be improved to mitigate risks, ultimately benefiting your business even before a policy is bound. It encourages a proactive approach to risk management, which can lead to lower premiums and fewer claims in the long run.

Moreover, when you are soliciting quotes from multiple insurance providers, using a standardized questionnaire ensures that each provider is basing their offer on the same set of facts. This creates a level playing field, making it much easier to compare different proposals apples-to-apples. You can confidently evaluate coverage limits, deductibles, and premiums, knowing that each quote reflects a comprehensive understanding of your specific needs, rather than varying assumptions. This transparency is crucial for making an informed decision that truly serves your business’s best interests.

Ultimately, this systematic approach helps in securing coverage that is not only comprehensive but also cost effective. By presenting a clear and complete picture of your business, you enable insurers to provide their best possible rates, avoiding the inflation that often comes from uncertainty or perceived higher risk due to insufficient information. It transforms the insurance procurement process from a reactive chore into a strategic advantage, ensuring your business is protected without overpaying.

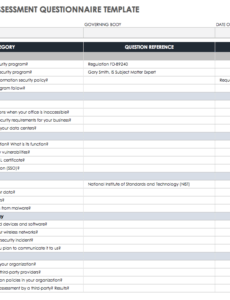

Key Elements to Include in Your Template

When developing or adapting a commercial insurance questionnaire template, certain categories of information are universally important. Here is what you should ensure is covered:

- Basic Business Information: Your legal business name, operating name, physical address, mailing address, Employer Identification Number EIN, business type sole proprietor, LLC, corporation, and years in operation.

- Operational Details: A detailed description of your services or products, annual gross revenue, number of employees full-time and part-time, and a list of all locations owned or leased.

- Asset Information: Details about your real property commercial buildings, inventory values, equipment values including computers and machinery, and information on any vehicle fleet.

- Employee Information: Total annual payroll, specific job roles, independent contractors used, and details on any employee benefits programs offered.

- Specific Risks and Liabilities: Information on cyber security measures, professional services offered, data handling practices, contractual obligations, and any unique exposures related to your industry.

- Claims History: A summary of any past insurance claims over the last 3-5 years, including dates, types of loss, and amounts, along with any actions taken to prevent recurrence.

Tailoring Your Template for Maximum Effectiveness

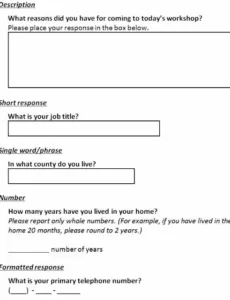

While a generic commercial insurance questionnaire template provides an excellent starting point, its true power lies in its ability to be customized to your specific business and industry. No two businesses are exactly alike, and what might be a crucial question for a manufacturing plant could be irrelevant for a tech startup. Taking the time to refine the template ensures that you are gathering the most pertinent information for your unique risk profile, making the insurance acquisition process even more precise and efficient. This customization reflects your commitment to accuracy and helps insurers better understand your niche.

To effectively tailor your template, consider the unique risks inherent to your industry. For example, a construction company will need to detail project types, safety protocols, and subcontractor relationships, while a retail business might focus more on inventory security, customer traffic, and point-of-sale systems. Think about the scale of your operations as well; a small home-based business will have different needs than a multi-national corporation, requiring more or less granular detail in certain sections. This thoughtful adaptation prevents unnecessary questions and focuses on what truly matters for your coverage.

The language and structure of your template also play a significant role in its effectiveness. Use clear, unambiguous language that avoids industry jargon where possible, ensuring that anyone completing the questionnaire can understand exactly what information is being requested. Organize the questions logically, perhaps grouping similar topics together, to make the completion process smooth and intuitive. A user-friendly questionnaire encourages more thorough and accurate responses, which in turn leads to better insurance outcomes. Remember, the goal is to facilitate clear communication, not to create confusion.

Finally, remember that your business is not static, and neither should your commercial insurance questionnaire template be. As your business grows, diversifies, or faces new challenges, your insurance needs will evolve. Make it a practice to review and update your template periodically, perhaps annually or whenever there are significant changes to your operations. This ensures that the information you provide for your insurance renewals or new policies remains current and accurately reflects your business’s evolving risk landscape.

Securing the right commercial insurance coverage is a foundational step for any thriving business, and a meticulously prepared questionnaire serves as your primary tool for achieving this. By systemizing the information gathering process, you not only save valuable time and resources but also ensure that your business is presented accurately and comprehensively to insurance providers. This precision leads to more accurate quotes and policies that genuinely align with your operational realities and risk exposures.

Ultimately, a well-executed information gathering process, guided by a robust commercial insurance questionnaire template, empowers you to make informed decisions about your coverage. It translates into peace of mind, knowing that you have proactively addressed potential vulnerabilities and secured the protection necessary to navigate future challenges with confidence and resilience. Your business deserves nothing less than the best possible foundation for its continued success.