Free quitclaim deed form printable pdf word 55% off idaho quit claim deed template sample – Ever found yourself gazing in confusion at an official form, feeling completely overwhelmed amidst a maze of complex wording? Deeds, those authoritative documents that transfer ownership of property and assets, may appear daunting. No need to be alarmed, you don’t need to be a lawyer to understand the basics and draft a straightforward document personally. A structured property form serves as a valuable asset, a pre-formatted document designed to guide you with the key aspects. Think of it as a guided legal framework for official records, helping make the steps less complicated and not as intimidating. We’ll analyze what a deed is, when you might need one, and ways a structured document can simplify the whole process.

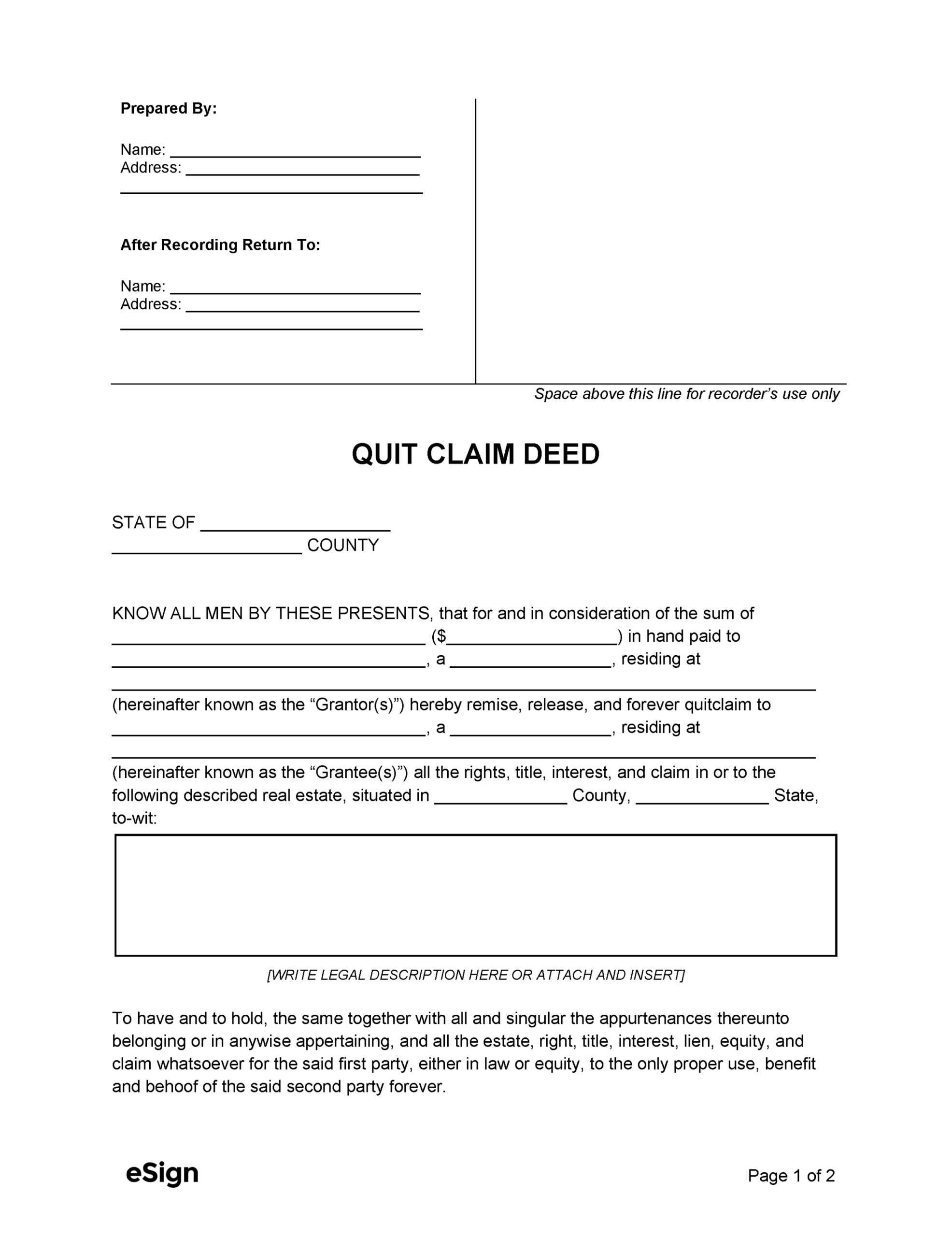

The beauty of a deed template lies in its structure. It offers a guide, ensuring you include all the necessary information, from the grantor responsible for conveying property and the recipient who acquires possession to the well-defined asset outline. It reduces the likelihood of typical mistakes and guarantees your paperwork is compliant. Such structured forms are crafted to align with ownership laws, which minimizes the chances of ownership conflicts or disagreements. However, attention to detail remains key in filling out the template, though, as incorrect or missing information may render the ownership transfer void.

Whether you’re transferring a section of property, a transport asset, or intellectual property, a formal property agreement is necessary. It acts as formal confirmation of possession transition and legally establishes the legal entitlements of both the current owner and the new holder. Even though complicated cases may demand the expertise of a legal professional, many straightforward transfers can be completed efficiently with a carefully picked and correctly finalized template. Let’s discuss how predefined documents can empower you in managing property agreements with greater clarity and certainty.

A property document is much more than standard paperwork; it functions as an enforceable certificate that moves legal possession or a claim to assets, typically real estate. Think of it as an agreement, except documented officially and contractually secure. It legally confirms the change in ownership from the previous titleholder (the grantor) to another (the buyer). If a deed is incomplete, changing ownership rights may encounter legal obstacles, or outright unlawful. Think of it like this, ownership cannot change hands without documentation.

There are several types of deeds, each ensuring different levels of protection and safeguards. The most common are general warranty deeds, which provide the strongest legal backing to the buyer, securing their legal rights against any prior claims that could have occurred prior to the transferor acquiring the estate. Limited coverage ownership documents offer a lesser guarantee, ensuring security solely against ownership complications that emerged throughout the transferor’s tenure. Unlike warranty agreements, quitclaim forms provide zero assurance and merely convey any stake the grantor possesses in the property. Choosing the proper ownership document is determined by the nature of the property exchange and the level of risk the recipient is prepared to accept.

While a deed template offers a great deal of assistance, it remains essential to keep in mind that it does not replace for legal advice. Each situation present individual challenges, and it’s always best to obtain input from a legal expert to confirm that the predefined agreement is suitable for the details of your estate transfer and that you understand the contractual obligations of the document. A lawyer can also help your document modifications to clarify any distinct situations or concerns. This is especially crucial when dealing with complex property transfers or complicated contractual arrangements.

So, when might you need a deed? Common scenarios include acquiring or transferring land, legally shifting assets within a household, donating land, updating name listings on legal documents, and securing assets within a legal framework. Under any of these conditions, a correctly completed ownership document is imperative to legally transfer ownership. Using a free deed template may serve as a budget-friendly option, though it is fundamental to confirm that the document you select is suitable for your transaction and aligns with all applicable laws.

Although using a well-designed deed template, meticulous attention to detail is crucial. Confirm that all information is correct and aligned within the ownership file. Double-check names, physical listings, estate specifications, and any other relevant details. A slight inaccuracy might make unenforceable the deed or cause contractual issues down the line. If you have any doubts regarding the precision of the details, seek expert guidance to ensure proper documentation.

One of the most critical aspects of establishing an enforceable document is the asset identification. This requires accuracy and clear. Vague or inaccurate descriptions can lead to misinterpretation and contractual conflicts. The estate details needs to feature the full legal description as registered in prior ownership records, containing the estate identifier, sectioned division, regional classification, as well as supplementary verification points. When required, request verification or title company to confirm definitive estate classification.

An essential consideration to take into account is ownership security coverage. Title insurance safeguards the new owner against possible disputes concerning ownership that may come up from previous complications, like outstanding debts, ownership disagreements, or unlawful title shifts. While a warranty deed ensures limited coverage, ownership safeguard provides an extra layer of security, confirming that your property is safely guaranteed. It’s a one-time payment that guarantees long-term security while preserving your title claim for an extended period.

Be aware that a complimentary ownership document is merely an initial step. It must be tailored to match your unique case. Enter all required details accurately and completely. Verify the estate’s official details against existing records. Make sure that the seller and buyer’s identities are entered exactly as required. If you’re unsure in relation to any aspect of the form, reach out to an ownership expert or certified lawyer.

The world of property law might feel complicated, however, with strategic foresight and the right resources, you can navigate the legal procedures effectively. Initiate by gaining knowledge with distinct property transfer agreements, learning the applicable legal statutes, and requesting specialized guidance should uncertainty arise. Helpful tools exist to help you from beginning to end, from free deed template options to real estate advisors and regulatory agencies. Being proactive and knowledgeable is essential to a smooth and secure property transfer.

Transferring property does not need to be overwhelming. With adequate knowledge and resources, it becomes possible to oversee the process and guarantee a smooth and properly structured transfer. Investing energy to explore the complexities of title documents and employing thorough verification when selecting and filling out a complimentary ownership form will pay off in the long run, preserving your rights and avoiding ownership disputes.