Editable 46 free quit claim deed forms & templates template lab old school house deed template doc – Have you ever been gazing in confusion at a complicated contract, wondering what it all means in a sea of jargon? Deeds, these critical legal files that establish possession within real estate and holdings, can seem intimidating. Don’t panic, you don’t have to be an attorney to grasp the fundamentals and even create a simple one yourself. A preformatted legal document can be your best friend here, a prepared ownership record intended to help through the essential elements. Consider it as a fill-in-the-blanks approach for official records, simplifying the method less complicated and not as intimidating. We’re here to explain what a deed is, the times they become relevant, and how a deed template can simplify the whole process.

The benefit of a deed template is within its organization. It provides a framework, ensuring everything required is accounted for, from the grantor responsible for conveying property and the recipient who acquires possession to a clear and accurate property description. It helps you avoid common pitfalls and guarantees your record follows proper regulations. Such structured forms are structured to meet statutory conditions, which lowers the risk of future disputes or challenges. However, attention to detail remains key when completing the document, though, as incorrect or missing information may render the ownership transfer void.

That said, keep in mind that working with a no-cost property document requires careful attention. You’ll need to ensure it adheres to your state’s specific requirements and accurately reflects the transaction. We’ll examine those aspects further, offering you the understanding to manage this step with confidence. Let’s analyze the fundamentals and help you on the path to legally transferring property.

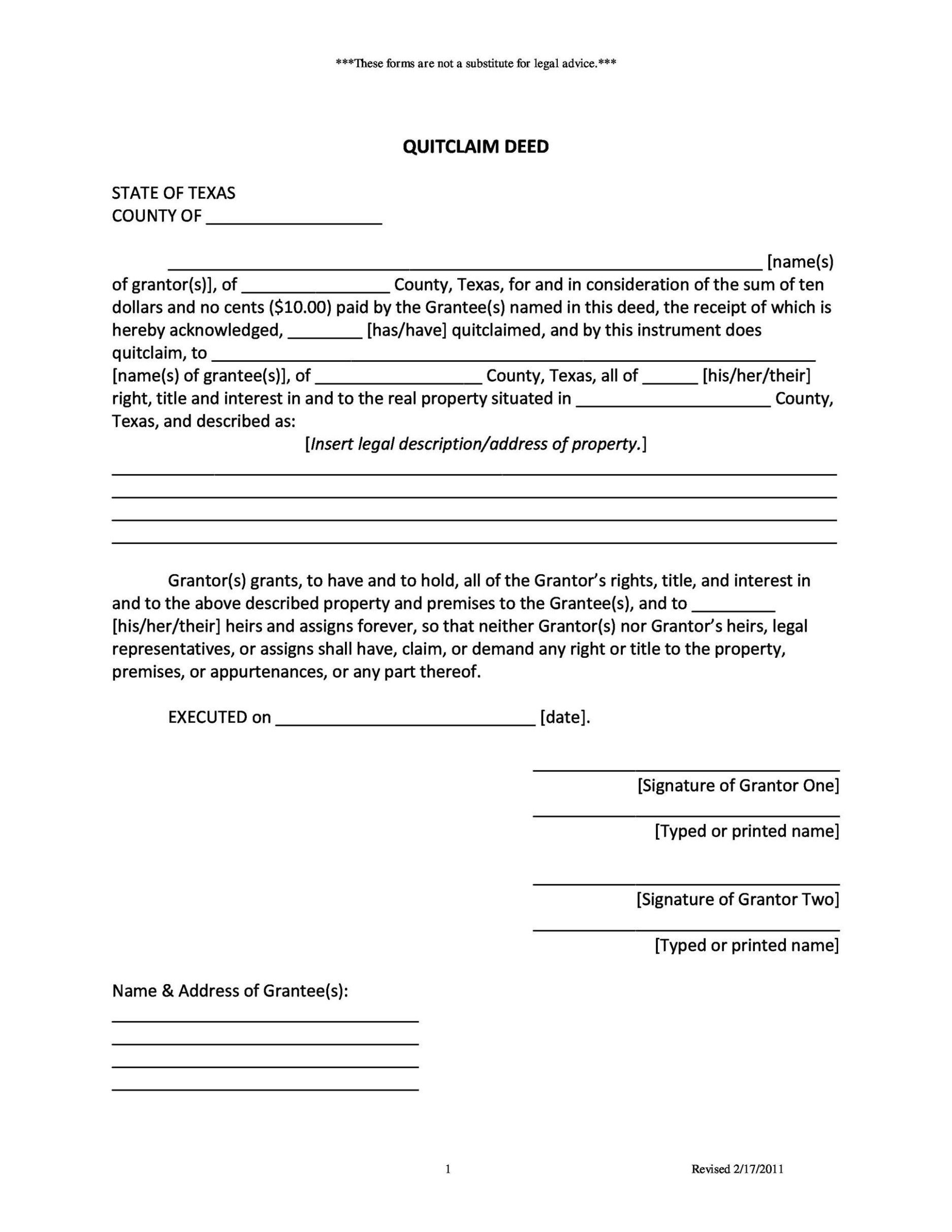

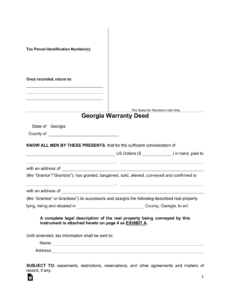

Deed templates exist for a variety of purposes, from transferring property ownership (warranty deeds, quitclaim deeds) to creating access rights or setting up estate plans. This range is crucial as the specific requirements for each type of deed can require unique details. For example, a secured title agreement offers the buyer maximum security, confirming rightful property claims and defending against any past claims. Conversely, an informal ownership agreement only passes along the available rights the current titleholder possesses in the land, without any guarantees. Picking the correct legal format is paramount.

Multiple forms of property documents are available, each granting distinct legal safeguards to the new owner. Take a warranty deed as an illustration, ensures maximum coverage, assuring that the seller holds undisputed ownership over the real estate and can defend against disputes. Conversely, a quitclaim deed grants the lowest level of assurance, merely conveying any title rights the seller holds in the real estate, without formal assurances. Choosing the right type of deed is essential for proper legal recognition of the transaction.

The nature of the property agreement selected depends on the specifics of the transaction and the level of protection granted to the new owner. A few frequently used formats consist of warranty deeds, limited-security estate files, and grant deeds. A comprehensive legal agreement provides the most protection, assuring that the grantor possesses legal ownership and the right to transfer the property. Conversely, a simple transfer form only passes along whatever interest the grantor has, without formal protections. This is often used when transferring property between family members or in financial agreements. Understanding the differences among these ownership formats is fundamental in verifying the correct form is applied for your unique circumstances. Make sure to get proper guidance, or locate resources for accurate information.

Ownership documents generally include essential components. These elements are the registered details of both parties involved, an unmistakable and legally valid outline of the property being transferred, a statement of consideration (detailing the agreed compensation, even if symbolic), accompanied by the seller’s endorsement. The deed must also be properly notarized and recorded in the county records office to establish transparent documentation of the ownership exchange. Neglecting to follow with these statutory obligations can render the deed invalid, resulting in conflicts in the future.

Applying a structured form simplifies this process by providing a pre-structured document that directs you to enter every required detail. This lowers the risk of errors and ensures that your title document complies with legal requirements. However, it is key to acknowledge that an ownership agreement is merely an initial step. It’s important to be fully aware of the specific requirements of your jurisdiction and to consult with an attorney should uncertainty arise or complex circumstances.

One of the most critical aspects of generating a legally sound agreement is the asset identification. This must be precise and legally definitive. Unclear or flawed specifications can lead to confusion and legal challenges. The property description should include the full legal description as it appears on the existing deed, featuring the designated code, sectioned division, regional classification, as well as supplementary verification points. When required, consult with a surveyor or title company to secure precise asset identification.

After completing the deed template, it’s essential to obtain a legal assessment by a qualified lawyer. A legal professional can evaluate the ownership file for correctness, adequacy, and compliance with governing regulations. They may assist concerning possible concerns or legal risks and validate that the property transfer correctly conveys your desires. This document verification can provide peace of mind and help prevent costly mistakes.

Notarization is a mandatory procedure in the deed creation process. A certified legal witness acts as an unbiased observer who verifies the identity of the property transferor and confirms that they are doing so voluntarily. Accurate title confirmation is mandatory for the property document to be legally submitted into formal databases, which remains crucial for securing legal possession and protecting your interests. Ensure you familiarize yourself with the notarization requirements in your governing region and follow them carefully. Most states stipulate that the property transferor, the entity executing the transaction, to be physically available and identified at the notarization.

The realm of real estate regulations might feel complicated, but with careful planning and appropriate guidance, you can navigate the process successfully. Initiate by gaining knowledge with the different types of deeds, grasping the regional regulations, and requesting specialized guidance should uncertainty arise. Helpful tools exist to help you every step of the way, from free deed template options to real estate advisors and regulatory agencies. Maintaining awareness and well-prepared is fundamental to a smooth and secure property transfer.

Essentially, a well-prepared property document, whether created from scratch or developed using an established format, offers considerable legal weight. It provides clarity, safeguarding, and assurance, ensuring that your estate claims are legally secure and your intentions are formally recorded. The impact of a well-executed deed goes further than the specific reassignment, creating a lasting record of ownership that will support long-term heirs. It serves as evidence of the necessity of verified paperwork and the importance of securing your property rights.