Free 18 printable mortgage agreement pdf forms and templates florida mortgage deed template excel – Do you sometimes find yourself needing a legally binding document yet confused by the challenging structure of formal legal language? You’re not the only one. Legal instruments, those seemingly ancient scrolls of property ownership and legal records, play a key role in various real estate dealings. No need to worry! You don’t have to be an attorney to create one. This is where a good deed template comes in handy, a practical guide to ensure you’re on the right track.

If you’re donating a piece of land to a loved one, selling a piece of land, or making changes to legal records, a property deed is essential. Securing the correct paperwork and confirming it’s properly executed is necessary to a hassle-free transaction. Dealing with ownership regulations can feel complex, but we’re here to provide assistance. We’ll explain the fundamentals, clarifying the role of a deed, the multiple forms you may need, and where you can find materials to assist you in the process.

A structured ownership form is basically a legally structured record that offers a consistent layout for creating a legally binding deed. It acts as a foundational structure, guiding you through key components that are required for the agreement to be enforceable and enforceable. The advantage of using a template lies in its ability to simplify the process, dividing detailed contractual obligations into easy-to-follow phases. It helps to avoid oversight that might make the agreement void, minimizing both stress and unnecessary expenses later. It cannot replace for professional legal advice, yet it remains a practical first step.

A deed is more than just a piece of paper; it’s a legal instrument that officially conveys rights or an interest in something, typically real estate. Think of it like a formal deal, yet recognized in law and legally binding. It legally confirms the transfer of possession from the previous titleholder to the transferor to another (the legal claimant). If a deed is incomplete, transferring property or assets may encounter legal obstacles, or entirely invalid. Consider it this way, ownership cannot change hands without documentation.

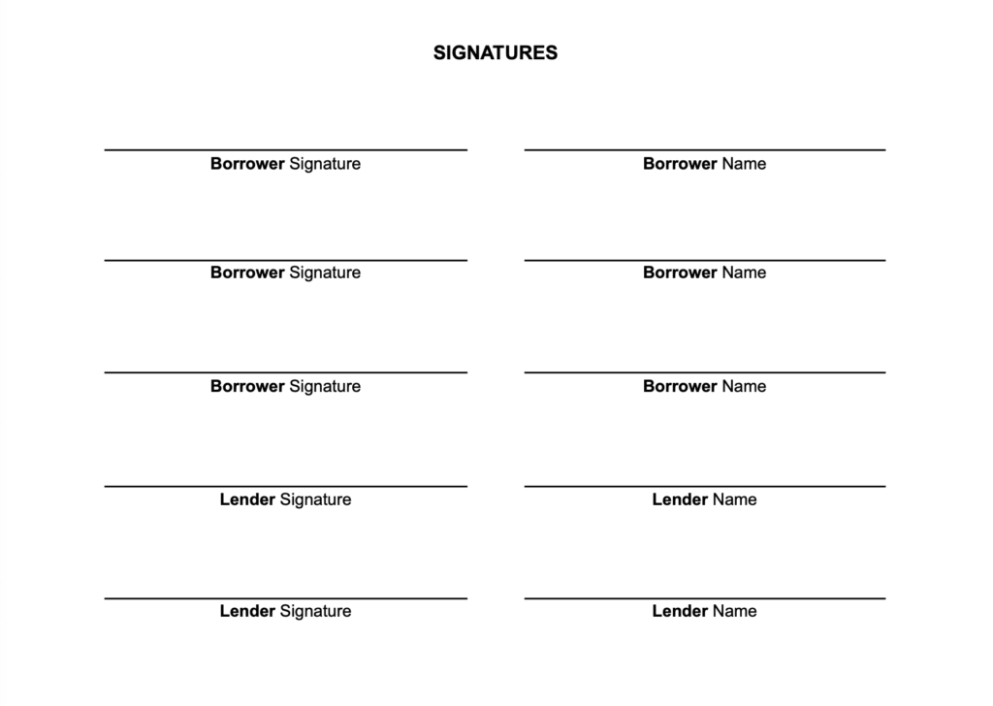

Applying a structured property form aids in securing that every required detail is incorporated in a standardized arrangement. This typically includes the full identities and locations of all parties involved (seller and buyer), a precise and legally valid outline of the ownership claim that is reassigned, the monetary valuation (the amount paid, if any), and any specific conditions or limitations affecting the ownership transition. A properly structured form typically incorporates the designated authorization fields and acknowledgment sections for formal authentication.

Despite the availability of a predefined estate form offers a great deal of assistance, it’s crucial to keep in mind that it cannot serve as an alternative for specialized legal counsel. Every case is unique, and it remains wise to seek guidance from a lawyer to ensure that the structured document is appropriate for the details of your estate transfer and that you are aware of the legal implications of the document. An attorney may assist your ownership agreement adjustments to address any specific circumstances or conditions. This remains highly necessary for handling detailed real estate transactions or intricate legal agreements.

In what situations is a property document required? Typical instances involve buying or selling property, transferring property between family members, gifting property, modifying registered ownership, and transferring property into a trust. For all these scenarios, a properly executed deed is required to validate estate reassignment. Utilizing a complimentary ownership record could function as a financially viable approach, but it’s critical to verify that the template you choose is appropriate for your property exchange and aligns with all applicable laws.

Applying a structured form helps streamline completion by supplying a pre-structured document that directs you to enter all the necessary information. This minimizes the likelihood of inaccuracies and guarantees that your title document adheres to regulatory guidelines. However, it’s crucial to remember that an ownership agreement is merely an initial step. It’s necessary to recognize the distinct regulations of your governing body and to consult with an attorney if you have any doubts or complicated conditions.

A predefined property record offers a streamlined and financially practical method to prepare mandatory title transfers. It eliminates the need to start from scratch, reducing your important effort and administrative challenges. By providing a structured format, a title transfer record guarantees that you correctly provide every required detail, lowering the possibility of inaccuracies or missing items that might make the document legally void. This becomes highly useful for individuals inexperienced with contractual language and proper file structuring.

An essential consideration to keep in mind is property title protection. Ownership security assurance safeguards the recipient against possible disputes against the property that could surface resulting from earlier concerns, like outstanding debts, ownership disagreements, or unlawful title shifts. Although a secured property agreement provides partial security, legal title assurance adds further protection, ensuring that your investment is protected. It’s a one-time payment that can provide peace of mind while preserving your title claim for years to come.

Keep in mind that a free deed template serves as a basic foundation. You’ll need to customize it to match your unique case. Fill in all the blanks correctly and comprehensively. Double-check the estate’s official details with prior documentation. Guarantee that the transferor and recipient’s full details are entered exactly as required. If you’re unsure regarding any section of the document, consult to an ownership expert or certified lawyer.

Applying a structured ownership form can greatly simplify the process of transferring property or assets. Through choosing an appropriate document, customizing it to your individual requirements, and following the proper procedures for execution and recording, you are able to generate a valid title transfer that secures your claims. Keep in mind, while a deed template acts as a practical guide, requesting professional consultation whenever required remains the safest approach.

Ultimately, a well-prepared property document, whether structured manually or derived from a predefined form, offers considerable legal weight. It provides clarity, protection, and peace of mind, ensuring that your estate claims are safeguarded and your specified directives are formally recorded. The significance of a properly managed document goes further than the specific reassignment, establishing an enduring estate history that preserves legal claims for descendants. It serves as evidence of the necessity of verified paperwork and the critical nature of preserving your ownership claims.